Bitcoin (BTC) broke out of its all-time excessive on November 6, presently consolidating above that degree earlier than its subsequent transfer. Within the meantime, a cryptocurrency buying and selling skilled has set his BTC value targets for the weekend, aiming at greater ranges.

The dealer is CrypNuevo an Spanish analyst who has confirmed excessive accuracy and good win charge together with his trades and alerts. Finbold has lined loads of CrypNuevo’s analyses, which assist retail merchants and buyers to navigate Bitcoin’s risky value motion.

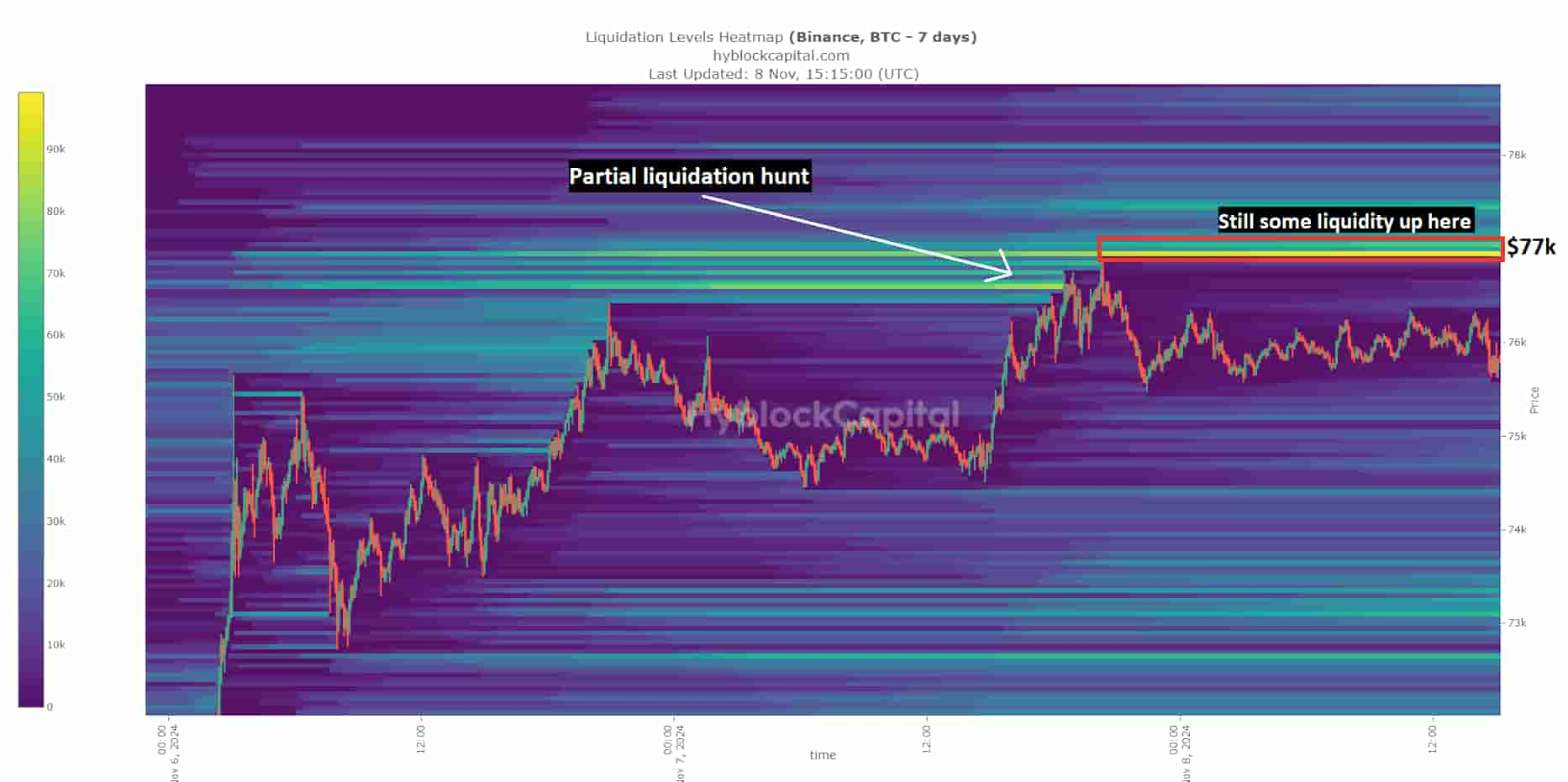

Particularly, CrypNuevo’s believes Bitcoin might short-squeeze to $77,000 and $77,500 at one level throughout the weekend. This is because of collected liquidations from quick positions between these ranges, making a magnet for BTC value.

“Yesterday, throughout FOMC, we noticed a partial absorption of the liquidations to the upside. And contemplating that there’s now much more liquidity between $77k-$77.5k because of the sideways transfer over the previous 16 hours… it’s extremely doable that we see a brand new spike as much as that zone.”

– CrypNuevo

Bitcoin value evaluation

Curiously, reaching the dealer’s targets for the weekend would drive Bitcoin to new all-time highs, persevering with its value discovery. It will additionally imply 19.5% features from present costs of $76,013.

The main cryptocurrency peaked at $76,884 after clearing the liquidity swimming pools following Donald Trump’s victory and the The Federal Open Market Committee (FOMC) assembly, breaking out of the $73,800 resistance reached in March, this 12 months.

What was beforehand resistance might now have change into a key value assist, which is but to be examined. Thus, earlier than reaching the $77,000 to $77,500 value goal, Bitcoin might retrace there, creating an impulsive baseline.

Alternatively, the correction might additionally come after reaching these targets and clearing the upward liquidity. BTC’s momentum on the every day chart is remarkably sturdy with a relative energy index (RSI) of 70.96.

Bitcoin mid-term technique: Time to purchase or promote BTC?

In the meantime, Ki Younger Ju, founder and CEO of CryptoQuant, is warning buyers of Bitcoin’s progress limitations. Based on the manager and onchain analyst, BTC would love go up 30% to 40% from present costs, however hardly a lot greater than that as many newcomers may need to imagine.

Ki Younger Ju believes we’re coming into a part available in the market the place Bitcoin buyers ought to be planning how and when to exit from their positions, as an alternative on going “all-in” just like the concern of lacking out (FOMO) might cause them to assume.

New buyers usually maintain $BTC by means of bear markets, enduring losses.

After about two years, it modifications palms when ache eases. That point is now.

It might go up +30-40% from right here, however not just like the +368% we noticed from $16K. Time to contemplate gradual promoting, not all-in shopping for, imo. pic.twitter.com/hXRT6YBsxS

— Ki Younger Ju (@ki_young_ju) November 6, 2024

This stance aligns with many different analysts who’ve been positioning to an anticipated altseason, together with CrypNuevo, as beforehand reported. Some stable altcoins might provide 30x-return alternatives, in response to cryptocurrency merchants, absorbing Bitcoin’s liquidity in an incoming altcoin bull rally.

Whereas skilled merchants and buyers set their methods and value targets, readers ought to stay cautious and perceive that even specialists may be fallacious and lose cash. Making a stable plan with correct threat administration and information is essential to navigate the market.