Ethereum (ETH), the main altcoin, has seen a big surge over the previous week, climbing 29% to a present three-month excessive of $3,184.

This rally has fueled hypothesis that ETH may quickly attain its year-to-date excessive of $4,095. As market sentiment improves and investor confidence builds, a number of elements might drive Ethereum to new highs within the coming weeks.

Ethereum Holders Chorus From Promoting

Ethereum’s coin holding time has elevated by 40% up to now seven days. This metric measures how lengthy a coin stays in an handle earlier than being transferred or offered.

A rising maintain time signifies rising long-term confidence amongst traders. When holders select to not promote, it suggests religion in Ethereum’s future worth and reduces the influence of short-term worth volatility. This usually ends in worth stability and might enhance demand since fewer cash can be found for buying and selling.

Ethereum Coin Holding Time. Supply: IntoTheBlock

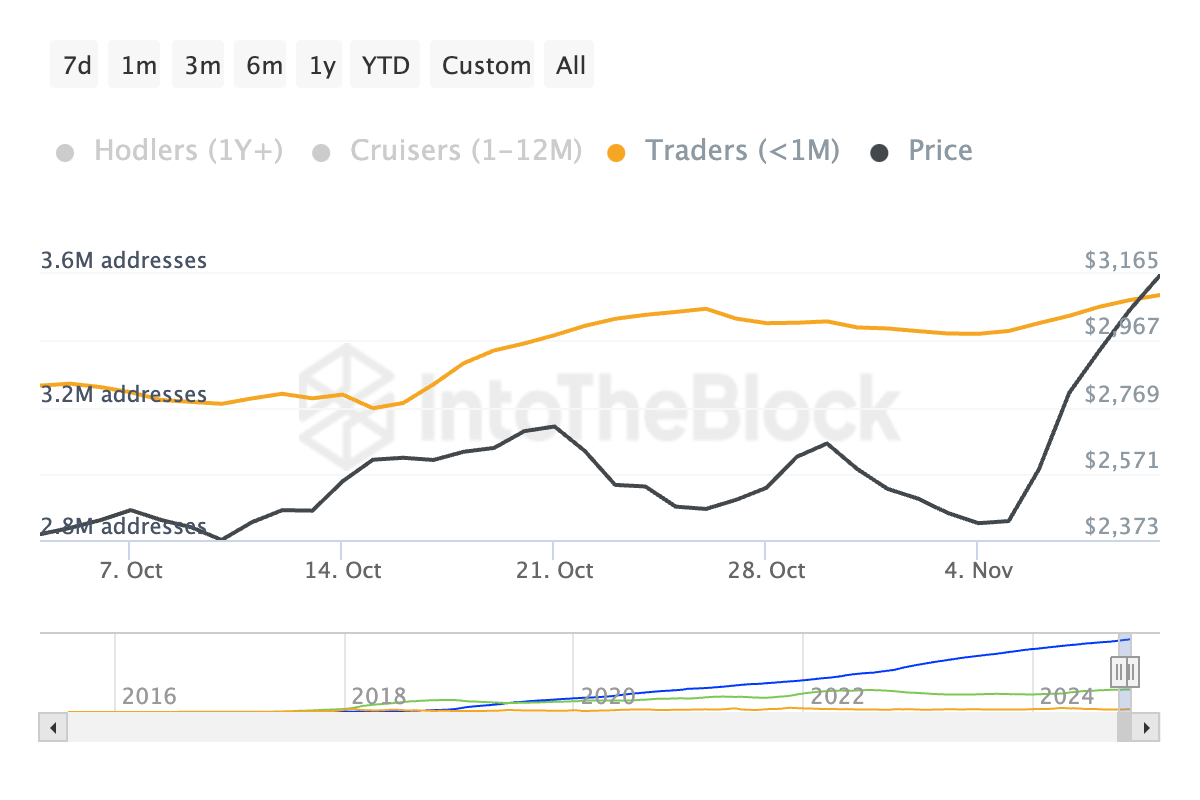

Along with long-term traders, Ethereum’s short-term holders (STHs) have additionally proven a notable shift in habits, selecting to carry onto their property somewhat than promote. Over the previous month, STHs — those that have held their cash for lower than 30 days — have elevated their holding interval by 9%, an indication of rising confidence within the asset.

This development is especially vital, as short-term holders management a large portion of Ethereum’s circulating provide. After they select to carry onto their cash, it reduces the promoting stress available in the market. This shift in sentiment additional reinforces the bullish outlook for ETH, as fewer cash can be found for instant sale.

Ethereum Addresses by Time Held. Supply: IntoTheBlock

Furthermore, Ethereum-based merchandise have been gaining vital consideration from market members. In its new report, digital asset analysis agency CoinShares discovered that Ethereum-backed crypto merchandise noticed a outstanding $157 million in inflows final week — the most important for the reason that launch of ETFs in July this yr.

“Ethereum, which has been floundering, noticed inflows of US$157m final week, the most important influx for the reason that ETF launches in July this yr, marking a substantial enchancment in sentiment,” the analysis agency stated.

ETH Worth Prediction: $4,000 Inside Attain

If the uptrend continues, Ethereum’s worth is more likely to set up assist on the $3,103 stage. This assist ground would pave the best way for an increase towards $3,337. A profitable breach of this stage would clear the following barrier at $3,671, opening the trail for the Ethereum worth rally towards the year-to-date excessive of $4,095.

Ethereum Worth Evaluation. Supply: TradingView

Nonetheless, if promoting stress intensifies, this bullish outlook may very well be invalidated. In that case, ETH’s worth might drop beneath $3,000, probably falling to round $2,869.