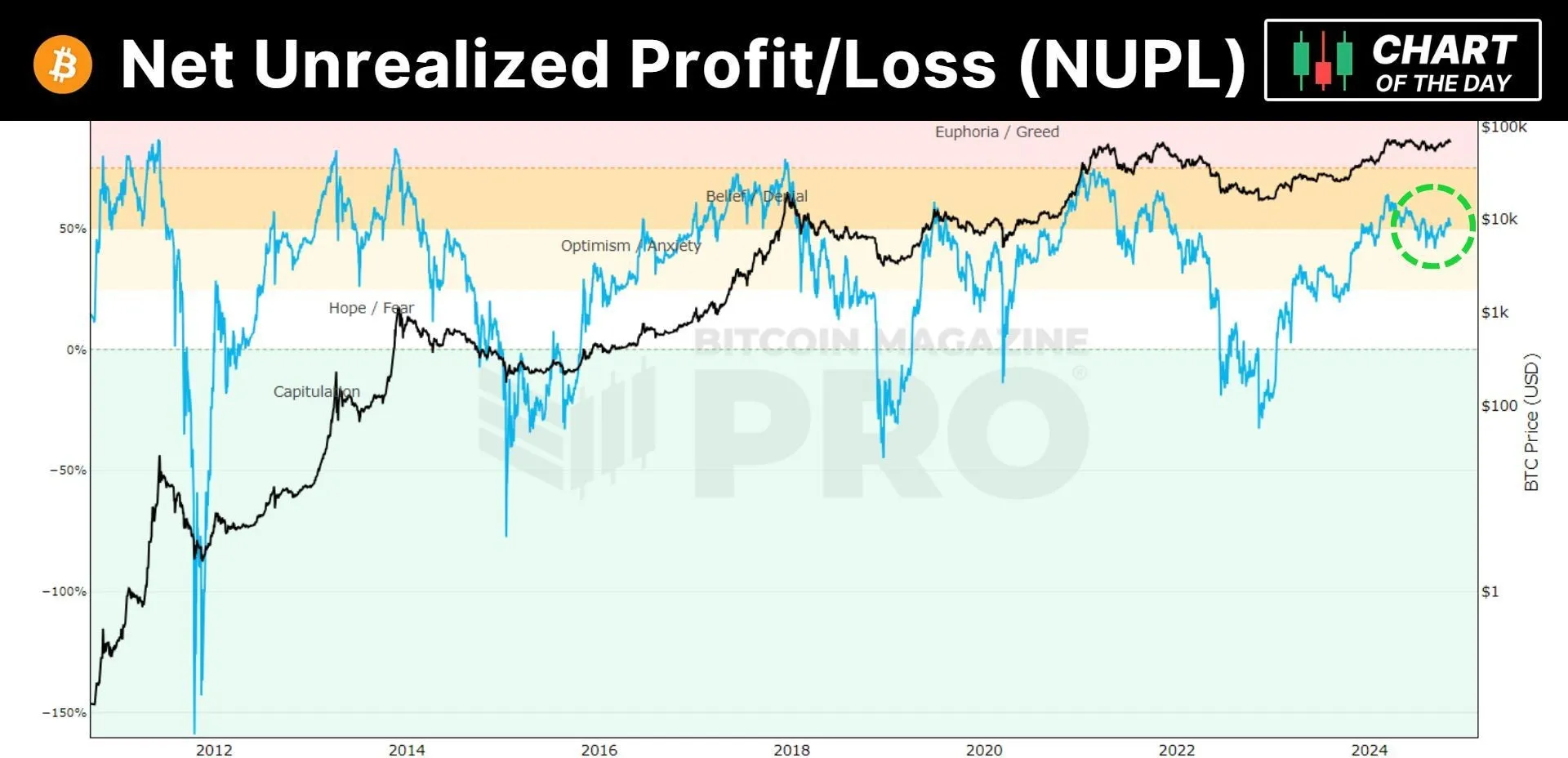

The Web Unrealized Revenue/Loss (NUPL) chart for Bitcoin supplied a vivid portrayal of investor sentiment and market phases.

As of press time, Bitcoin had re-entered the ‘Perception’ stage. It’s a part characterised by returning confidence and long-term holding as costs rise considerably above the final main peak.

The stage is normally adopted by the ‘Optimism’ part and preceded by ‘Euphoria.’ It signifies a robust, persevering with perception in Bitcoin’s potential for increased valuations.

– Commercial –

The development into ‘Perception’ is notable as a result of it instructed a majority of holders are in revenue however are usually not but compelled to promote, betting on additional value will increase.

The place of the NUPL line transferring solidly into the inexperienced zone supported this interpretation, reflecting a wholesome market optimism. Nevertheless, the precise length of this part stays unsure.

Traditionally, the transition from ‘Perception’ to ‘Euphoria’ has various considerably, relying on broader market circumstances, investor sentiment, and macroeconomic elements.

Whereas there’s room for development, the market’s subsequent transfer is ambiguous. Monitoring the NUPL for indicators of shifting sentiment which will precede a brand new part, doubtlessly heralding the height of the present cycle is essential.

Lengthy Liquidations Incoming

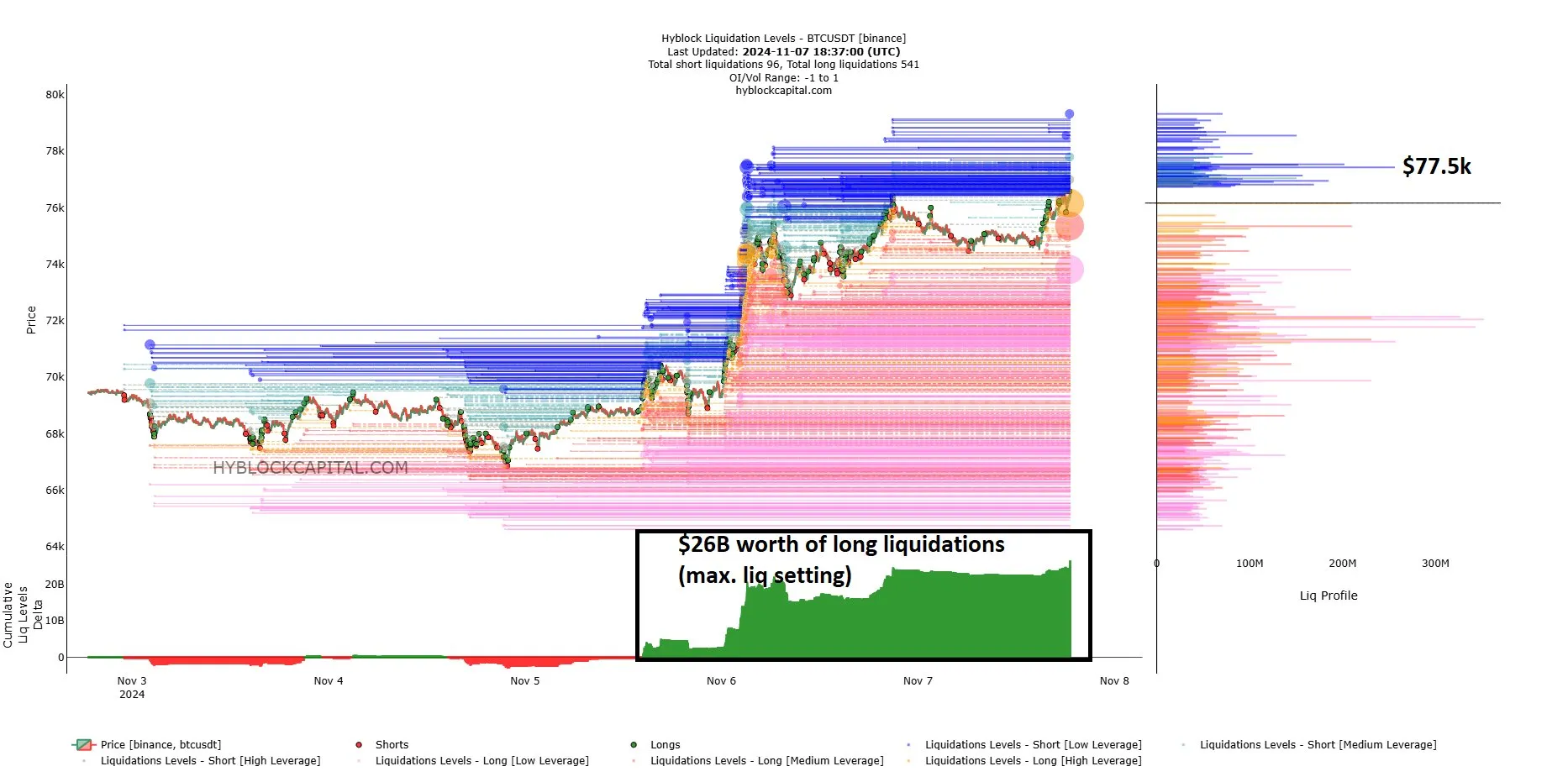

Bitcoin heatmaps highlighted crucial zones the place important value actions might happen as a result of liquidation occasions.

The primary chart confirmed a transparent resistance zone round $77.5k. This might be a goal throughout important market occasions just like the FOMC announcement.

The clustering of liquidation ranges just under this value signifies a excessive focus of cease orders. If triggered, that would propel the worth towards this higher restrict.

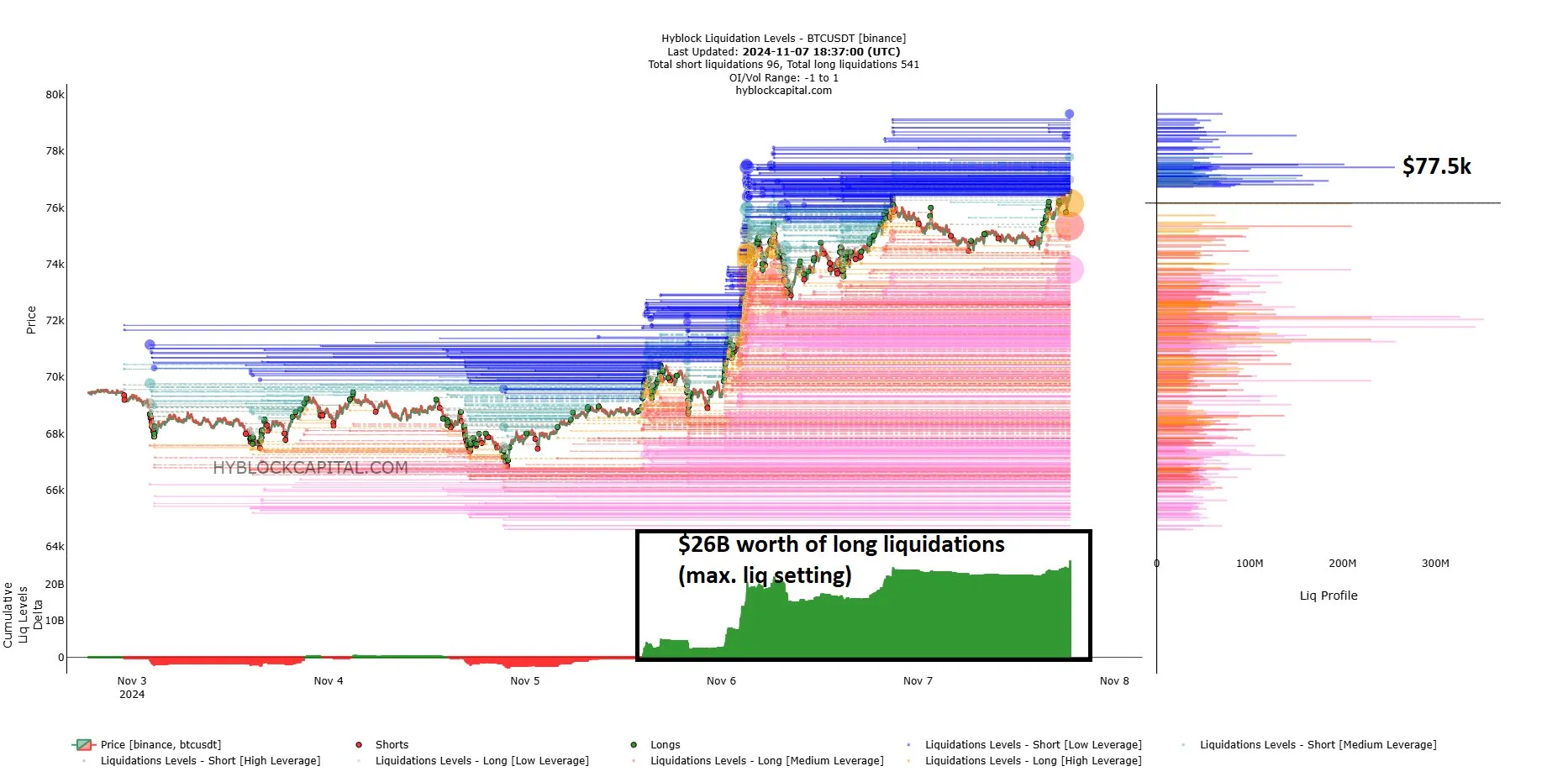

The second chart supplied an in depth view of latest buying and selling actions, displaying a surge in lengthy liquidations. This accumulation instructed that many merchants have been positioned for additional value will increase.

They’re utilizing excessive leverage, which elevated the chance of a protracted squeeze. If the market experiences a fast pullback, these lengthy positions might be liquidated en masse.

That will result in a pointy decline in Bitcoin’s value because the market makes an attempt to search out liquidity. Following the setup, the potential for a pullback to shake out FOMO-driven longs might be actual.

Merchants would possibly count on a tumultuous interval main as much as the weekend, the place volatility might improve as these liquidation occasions unfold.

The situation pointed to the opportunity of each a spike as much as $77.5k if bullish pressures prevail through the FOMC, adopted by a attainable sharp decline if the market corrects and lengthy positions are squeezed out.

Will $80K Mark The Prime?

The charts additional mirrored a recurring sample of rallies marked by euphoria phases that observe the second most distinguished pump in every cycle, as highlighted by the yellow circles.

Traditionally, after these pumps, Bitcoin skilled substantial good points: 362% in 2013, 566% in 2017, and 406% in 2021. Drawing from these patterns, the chart instructed a possible rise of 236% from the present degree round $74k.

This is able to challenge a prime close to $248k if the historic sample holds. Moreover, the chart signifies that these euphoric tops typically develop into focal factors in subsequent bear markets, as proven within the white packing containers.

As an example, within the 2015 bear market, Bitcoin’s value dipped just under the earlier euphoric excessive. In 2019 and 2022, it persistently held above it.

The remark supported the speculation that $70k to $80k might act as a crucial assist vary in any forthcoming bear market.

The timeline to achieve a brand new euphoric part might be influenced by related durations and development charges as previous cycles.

If Bitcoin follows the historic cadence, an acceleration towards euphoria is likely to be anticipated throughout the subsequent 1-2 years, contingent upon market dynamics and investor sentiment following the earlier patterns.