Ethereum’s current worth actions reveal a robust vendor presence, notably across the essential resistance area on the 100-day transferring common.

This worth motion suggests elevated downward strain, with a corrective consolidation anticipated within the close to time period.

Technical Evaluation

By Shayan

The Each day Chart

Ethereum lately encountered heightened promoting exercise on the $2.6K resistance space, aligned with the 100-day transferring common. This led to a rejection, pushing the asset again towards the dynamic help on the channel’s center trendline close to $2.3K. The presence of sellers at this resistance zone suggests it stays a big barrier for patrons, no less than for the center time period.

At present, ETH is buying and selling inside a confined vary between the channel’s center help boundary and the 100-day transferring common. A brand new uptrend could possibly be underway if the worth efficiently breaks above the 100-day MA and confirms a pullback.

On this state of affairs, Ethereum’s targets could be the 200-day MA at $2.9K and the channel’s higher boundary close to $2.8K. Nonetheless, if promoting strain intensifies and ETH breaks beneath $2.3K, it might revisit the $2.1K help, doubtless resulting in additional retracements.

The 4-Hour Chart

On the 4-hour chart, Ethereum’s current surge met vital promoting strain across the resistance zone between the 0.5 and 0.618 Fibonacci ranges ($2.6K-$2.8K). This space has served as a robust barrier, indicating a provide focus. A shift towards a bullish development will rely on worth motion round this zone and a confirmed breakout.

At present, Ethereum is holding close to the decrease boundary of the flag at $2.4K. A break beneath this help might set off a liquidation cascade, probably driving the worth towards $2.1K. Nonetheless, the extra doubtless state of affairs includes a consolidation part round this help degree, with ETH probably rebounding towards the 0.5 Fibonacci degree till a decisive breakout happens.

Onchain Evaluation

By Shayan

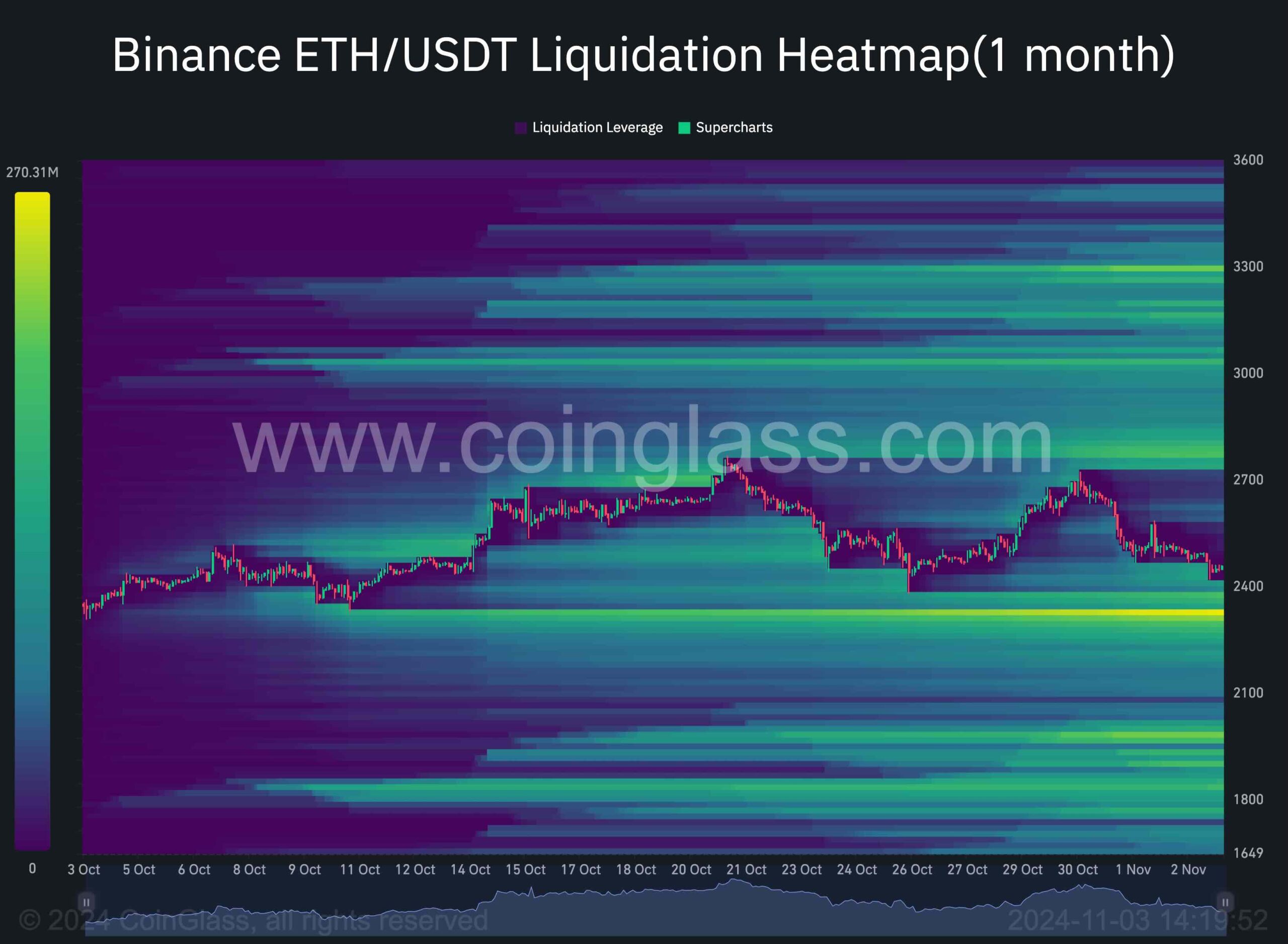

Ethereum’s worth has been consolidating inside a slim vary, signaling market indecision. Nonetheless, futures market insights reveal {that a} breakout might result in a considerable liquidation occasion, doubtless amplifying the prevailing development.

Based mostly on the chart, liquidity has concentrated beneath the $2.4K degree, suggesting this worth vary could also be pivotal within the brief time period. Vital liquidity swimming pools beneath $2.4K point out {that a} downward breakout might appeal to extra sellers and set off lengthy patrons to shut their positions, intensifying the bearish momentum.

This state of affairs raises the opportunity of a protracted squeeze, the place a cascade of liquidations might drive Ethereum’s worth all the way down to the $2.1K help degree. For sellers, the realm beneath $2.4K is a lovely threshold for reducing costs. Conversely, it represents an important protection line for patrons, whose actions close to this degree might be essential for figuring out the broader market development.

If ETH breaks beneath $2.4K, it might shortly drop towards $2.1K as a result of cascading impact of lengthy liquidations. Alternatively, intense shopping for strain at or close to $2.4K might assist stabilize the worth, probably averting additional declines.

Finally, Ethereum’s worth motion close to the $2.4K threshold might be decisive for the short-term development, and any motion past this vary might sign a extra decisive directional shift.