Subtle buyers and high-net-worth people typically use over-the-counter desks to execute trades with out instantly affecting the spot-market value.

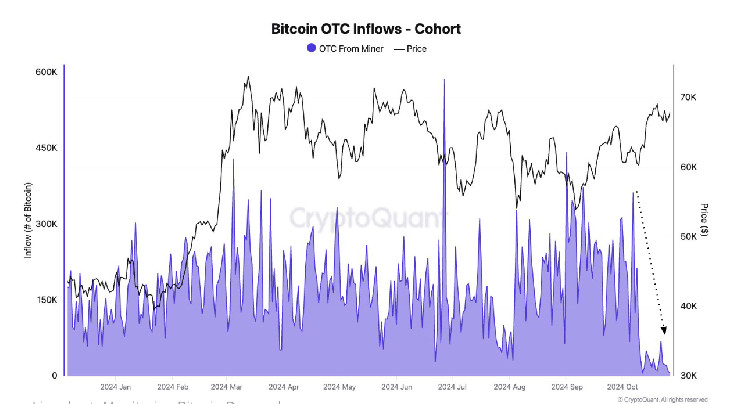

Previously 5 months, OTC desks have seen an increase of over 200,000 BTC, one of many highest ranges recorded lately.

As bitcoin (BTC) approaches a file excessive, subtle buyers seem like taking steps to commerce with out influencing the worth within the spot market.

At about $72,300 as of midday in Europe, the most important cryptocurrency by market worth is lower than 2% under the $73,798 file set in March, based on CoinDesk Indices information. Bitcoin has jumped about 14% this month, on observe for the largest one-month acquire since March.

A exceptional characteristic of this current bitcoin run is that over-the-counter (OTC) desks, which permit two events to commerce instantly with out disclosing info to the broader market, now maintain 416,000 BTC ($30 billion) in contrast with a mean of lower than 200,000 BTC in the course of the first quarter, based on CryptoQuant information.

OTC desks are primarily utilized by establishments or high-net-worth people preferring to keep away from having their transactions seem on crypto change order books, permitting them to transact massive portions with out affecting the market value. The rising stream to OTC desks is one cause the bitcoin value has been trending in a sideways channel for the previous seven months.

With an abundance of bitcoin on OTC desks, the U.S. spot-listed exchange-traded funds (ETFs) might make purchases with out affecting the spot value.

Even Tuesday’s file every day purchases by the bitcoin ETFs symbolize simply 2% of the entire bitcoin stability on OTC desks. Through the first quarter, with bitcoin posting an all-time excessive shortly after the ETFs acquired regulatory approval, the share of stock ranged between 9% and 12%.

The overall OTC desk stability, nonetheless, has held fairly regular because the starting of September. The 30-day change is simply 3,000 BTC, down from a June excessive of 92,000 BTC. Through the first quarter, the pent-up demand led to a adverse 30-day change in OTC desk balances, which helped propel the asset to its file excessive.

For bitcoin to go greater this cycle, every day inflows into OTC desks want to begin lowering, as is noticed at the moment. Each day inflows into OTC desks have declined to the bottom ranges this 12 months. CryptoQuant notes that in October, OTC desks averaged round 90,000 bitcoin, a discount of 52% in contrast with the primary three quarters of the 12 months.

If demand for BTC continues accelerating amid low inflows into OTC desks, this might propel bitcoin to new highs.