With gold and Bitcoin each at or close to document highs, the controversy over which is healthier ‘onerous cash’ is heating up as traders search hedges in opposition to financial uncertainty, inflation, and geopolitical change.

Desk of Contents

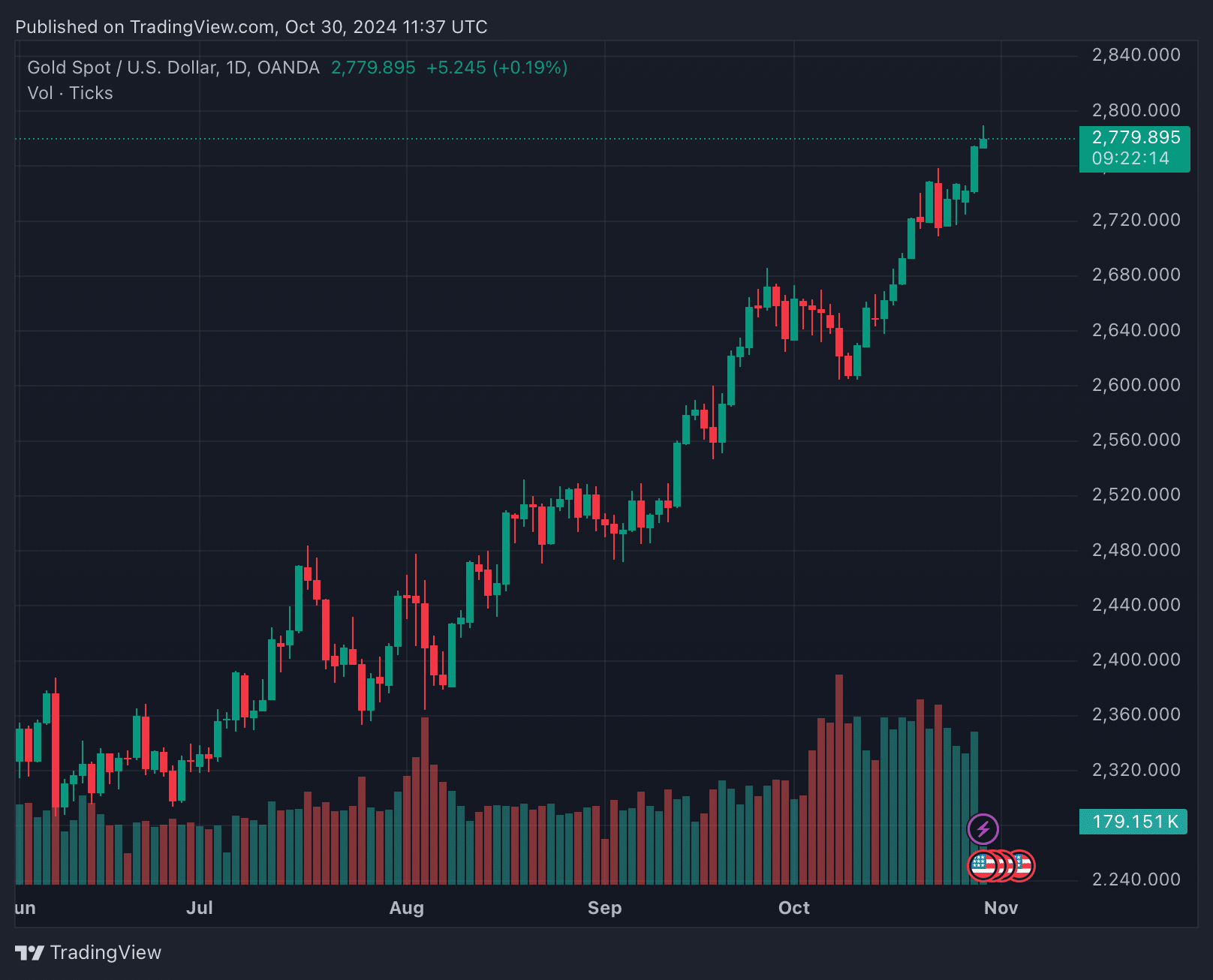

In a time of mounting financial pressures, two historically opposed property — gold and Bitcoin — are surging at or close to their all-time highs, stirring debate about their roles as “onerous cash.” As gold pushes previous the $2,770 mark and Bitcoin (BTC) hovers near its all-time excessive of $73,800, the simultaneous rallies trace at underlying market anxieties. Buyers are more and more eyeing each as defensive hedges in opposition to financial volatility, casting a highlight on the controversy over which asset higher holds its worth.

Gold Spot / USD market | Supply: TradingView

The necessity for understanding the onerous cash debate is crucial, particularly in unsure occasions, with the US election in a neck-and-neck race; questions have arisen as to which asset is a greater hedge in opposition to potential financial instability, inflation, and geopolitical shifts that would affect conventional markets.

Surge in valuable metals vs. Bitcoin

Over the previous yr, gold has risen by over 38%, whereas on the identical time, Bitcoin has risen a shade by over 115%. These peaks have drawn commentary from numerous traders on either side of the onerous cash debate, together with Chamath Palihapitiya, Larry Fink, and Peter Schiff.

In accordance with Palihapitiya, “Bitcoin goes to be the resounding inflation hedge asset for the subsequent 50 to 100 years,” he mentioned on a current podcast.

“You’re seeing the final vestiges of individuals utilizing gold as a rational financial insurance coverage coverage.”

However gold’s newest peak has additionally drawn commentary from distinguished advocates, corresponding to infamous metallic cash advocate Peter Schiff, who shared on X: “Gold closed at a document excessive above $2,755, on monitor for its finest yr since 1979.”

”The distinction is that in 1979, inflation was close to its peak and the gold bull market was close to its finish, whereas now, inflation is close to its trough and the gold bull market is simply getting began.”

Bullish sentiments on valuable metals, others are extra nuanced of their views of what onerous cash appears like within the twenty first century.

“The function of crypto is digitalizing gold,” mentioned Larry Fink, CEO of BlackRock on a current Fox Enterprise phase. “We hope regulators have a look at the Spot ETF filings as a strategy to democratize crypto,” the world’s main asset supervisor said.

You may also like: Gold hits new all-time-high at $2,700 amidst bullish Bitcoin

Bitcoin: ‘digital gold,’ retailer of worth or medium of change?

In contrast to gold, nevertheless, Bitcoin lacks a centuries-long monitor document and has confronted bouts of maximum volatility that may pose challenges for these in search of stability. Nonetheless, with Bitcoin nearing its all-time excessive, curiosity in its potential as “digital gold” continues to develop, particularly amongst youthful and tech-savvy traders who worth its portability and ease of switch.

The time period “digital code” is usually related to the event of pc science and digital info idea, but it surely doesn’t have a single, universally acknowledged inventor. Nonetheless, one of many earliest and most influential figures within the conceptualization of digital info is Claude Shannon. Shannon, in his groundbreaking 1948 paper “A Mathematical Idea of Communication,” laid the muse for digital encoding and knowledge idea, which helped form the idea of digital code, Bitcoin, and the concept that onerous cash could possibly be encoded through blockchain know-how, encryption and a cap on provide.

Are these rallies an early warning signal?

The rise in each gold and Bitcoin could possibly be greater than a mirrored image of particular person market dynamics; it might sign a rising unease with the broader financial system.

Traditionally, sharp strikes in these property have usually preceded financial downturns as traders search refuge from anticipated turbulence. This sample, as noticed within the early Seventies and through the 2008 monetary disaster, might counsel that right this moment’s worth surges are signaling a insecurity in conventional monetary markets.

Educational analysis helps this thesis. Analysis by Bouri et al. (2017) notes that Bitcoin can function “a hedge much like gold, significantly in response to foreign money devaluation and macroeconomic uncertainty.” That is echoed by Ratner and Chiu (2013), who noticed that “traders usually flock to property perceived as safer, together with valuable metals and various property like Bitcoin,” particularly in periods of monetary disaster. Reboredo (2013) additional helps this thesis by highlighting the steadiness of valuable metals like gold, stating that macroeconomic occasions and monetary crises “drive traders to hunt stability in gold,” reinforcing its function as a protected haven.

Certainly, gold’s provide grows incrementally via mining, with bodily constraints which have stored its worth secure over time. Bitcoin, nevertheless, operates on a set, coded provide cap of 21 million cash, which is predicted to be reached by 2140. This programmed shortage, mixed with Bitcoin’s halving occasions (which cut back the reward for miners each 4 years), has strengthened a deflationary view of the asset.

The onerous cash debate into 2025

As each gold and Bitcoin proceed to rally, traders are left with a vital selection: a standard asset that has lengthy served as a protected haven or a more recent, digital various with distinct benefits in portability and shortage. The talk over which is the higher “onerous cash” has but to be settled, however one factor is obvious—each property are resonating with a rising viewers that values stability in unsure occasions. Whether or not the financial system’s path will validate this defensive positioning stays to be seen, but when historical past is any information, gold, and Bitcoin could as soon as once more function early indicators of shifts on the horizon. Simply don’t point out Ethereum.

Learn extra: Gold appears extra enticing than Bitcoin in onerous occasions

Disclosure: This text doesn’t characterize funding recommendation. The content material and supplies featured on this web page are for instructional functions solely.