Ethereum’s current try to interrupt above the multi-month descending channel’s center threshold of $2.6K has turned out to be a false breakout, resulting in a notable rejection and sharp decline.

This sample suggests a possible mid-term continuation of the downtrend towards the $2.1K help degree.

By Shayan

The Each day Chart

Ethereum’s worth motion on the every day chart has highlighted a bull entice. Very similar to in late August, when ETH broke above the descending channel’s center threshold solely to be swiftly rejected, the same sample has unfolded lately.

After the value briefly surpassed the $2.6K resistance, it failed to keep up momentum and confronted appreciable promoting stress, leading to a 15% drop. This failure to ascertain the next excessive signifies sellers’ dominance out there.

Now, the cryptocurrency is approaching an important help zone of round $2.1K, which aligns with a earlier main swing low. It appears more likely to enter a descending consolidation part for the mid-term, regularly declining towards this key degree.

The 4-Hour Chart

On the 4-hour chart, Ethereum’s lack of ability to keep up upward momentum close to the 0.5 ($2.6K) – 0.618 ($2.8K) Fibonacci ranges triggered a bearish three-drive sample.

This well-known reversal sample and a bearish divergence between the value and the RSI indicator urged that sellers have been regaining management over the market. Consequently, Ethereum skilled a pointy decline, falling again towards the ascending flag’s decrease boundary of $2.3K.

At the moment, sellers goal to push Ethereum’s worth under the flag’s decrease boundary, which might doubtless start a contemporary bearish development. If this breakout to the draw back happens, ETH’s subsequent main goal could be the $2K psychological help. Nevertheless, the $2.1K threshold stays patrons’ first line of protection.

By Shayan

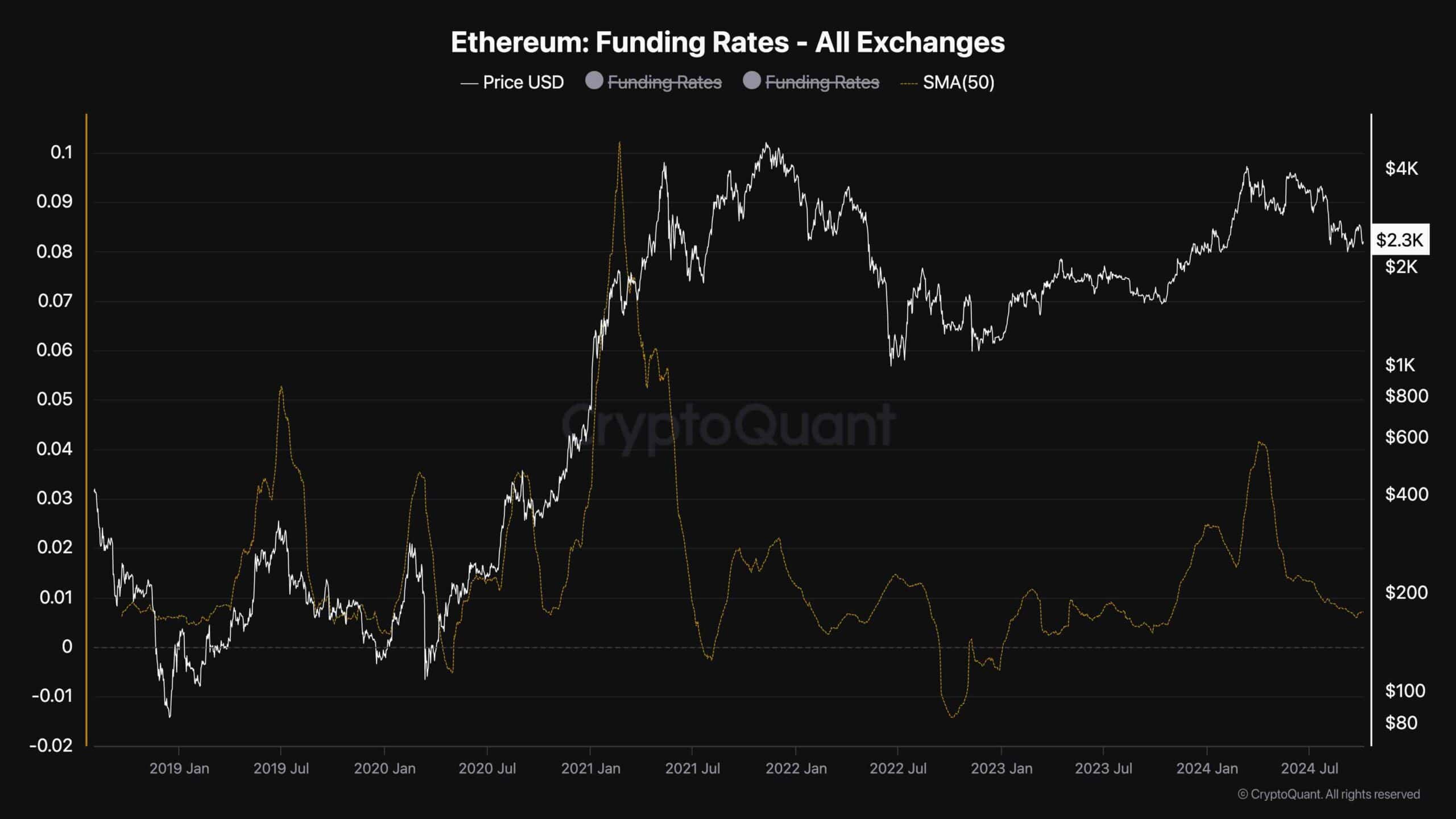

This evaluation focuses on the 50-day shifting common of Ethereum’s funding charges, which supplies a clearer image of the broader sentiment throughout the futures market.

Lately, ETH’s 50-day shifting common funding charge has been steadily declining, reaching its lowest degree in 2024. This persistent downtrend highlights bearish sentiment amongst futures merchants, indicating an general lack of shopping for curiosity out there. Such circumstances are sometimes linked to declining costs, as short-sellers dominate the market.

For Ethereum to get well and rise to larger worth ranges, demand from the perpetual futures market should enhance. The continual drop in funding charges means that the promoting stress is extra aggressive than shopping for curiosity, reflecting bearish expectations for ETH within the mid-term.

Though damaging funding charges are typically related to bearish circumstances, they’ll generally sign a possible market reversal.

This occurs via quick liquidation cascades, the place aggressive quick positions get liquidated, triggering a speedy surge in worth. For this to happen, nonetheless, substantial shopping for stress from the spot market must help a rebound.