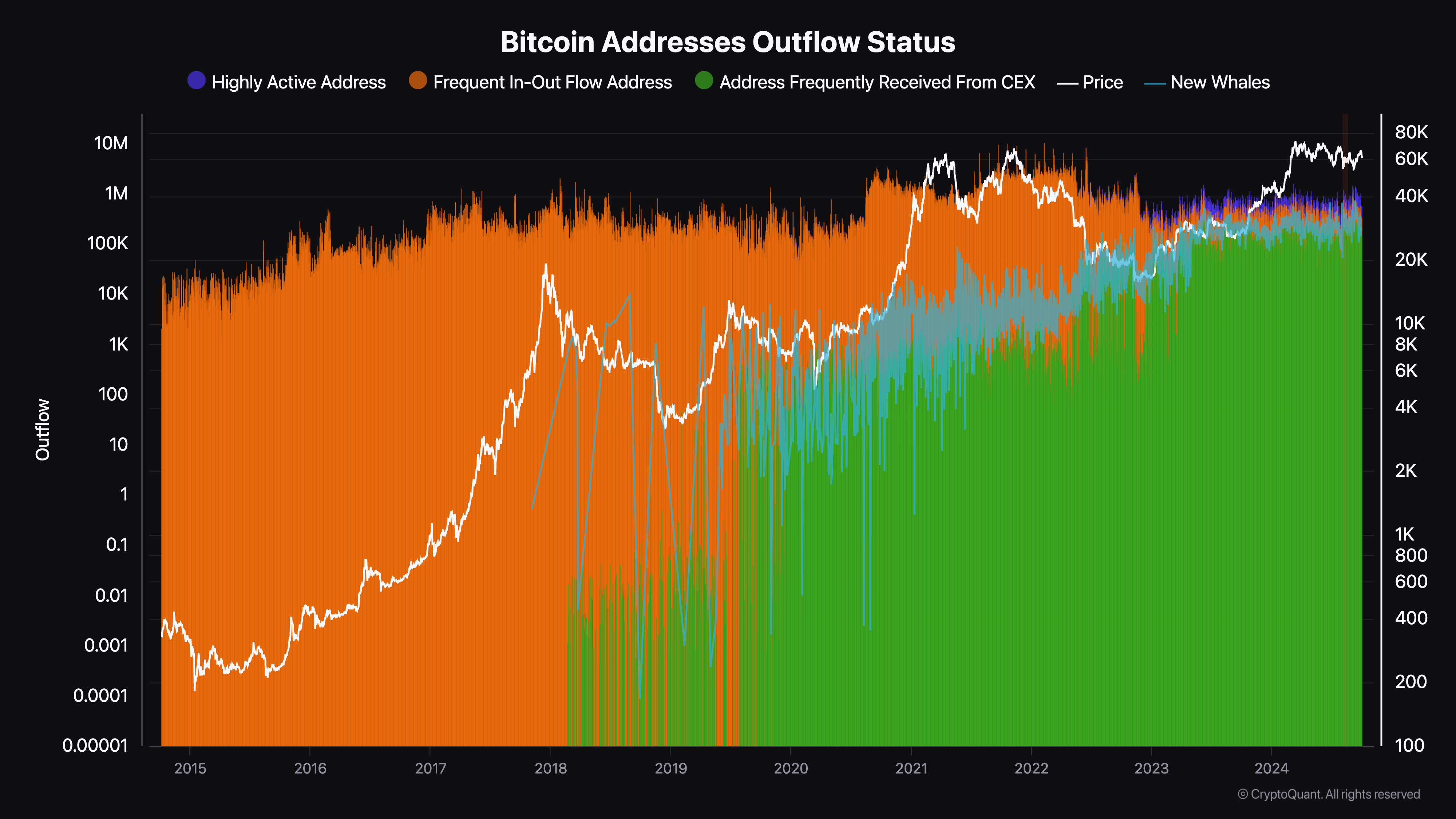

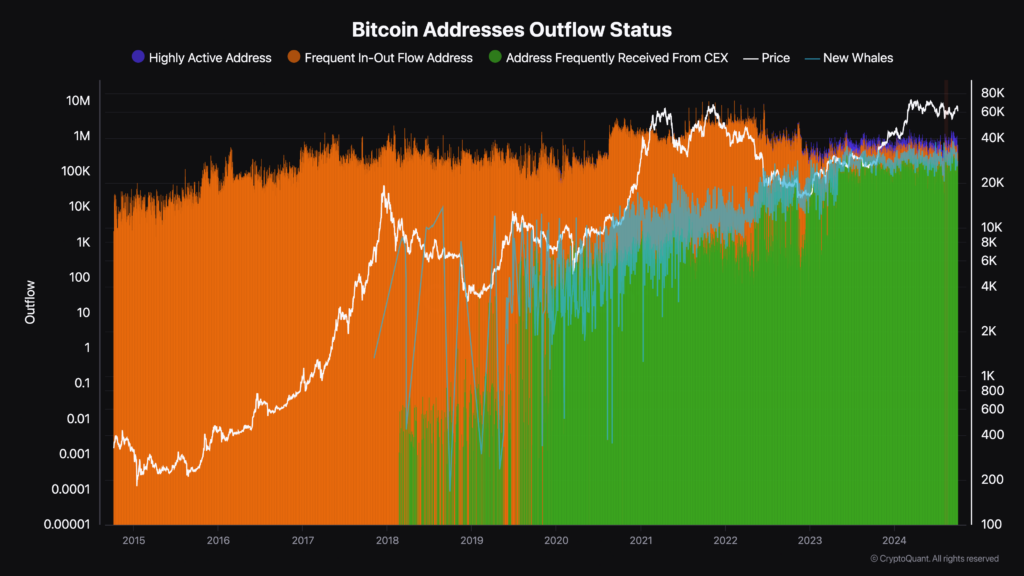

Evaluation of Bitcoin deal with outflow patterns signifies a correlation between deal with exercise varieties and Bitcoin’s worth actions from 2014 to 2024. Per CryptoQuant knowledge, shifts in outflow developments amongst totally different deal with classes replicate underlying market developments and participant behaviors.

From 2014 to 2017, frequent in-out circulate addresses dominated Bitcoin’s outflow panorama. This era coincided with low Bitcoin costs relative to immediately, suggesting that prime transactional exercise amongst these addresses didn’t considerably affect market valuation. The dominance of frequent in-out flows mirrors a market primarily pushed by smaller transactions and particular person customers participating in common transfers.

Round 2018, a notable shift occurred as addresses often receiving from centralized exchanges started to develop quickly. This development got here with a rise in Bitcoin held by or shifting by way of trade addresses attributable to heightened buying and selling exercise and elevated person adoption of exchanges.

The timing aligns with an upward development in Bitcoin’s worth, indicating a connection between trade exercise and market valuation. The prominence of exchange-related addresses might echo traders shifting property onto exchanges in anticipation of market actions or elevated speculative buying and selling.

The variety of new whale addresses recognized by new or present massive Bitcoin holders spiked originally of 2020. The spike coincided with elevated Bitcoin worth development and volatility, implying accumulation whatever the worth.

The inflow of recent whales throughout these durations means that institutional traders or high-net-worth people had been coming into the market, doubtlessly driving costs upward by way of substantial purchases.

Bitcoin deal with exercise from 2021 onward

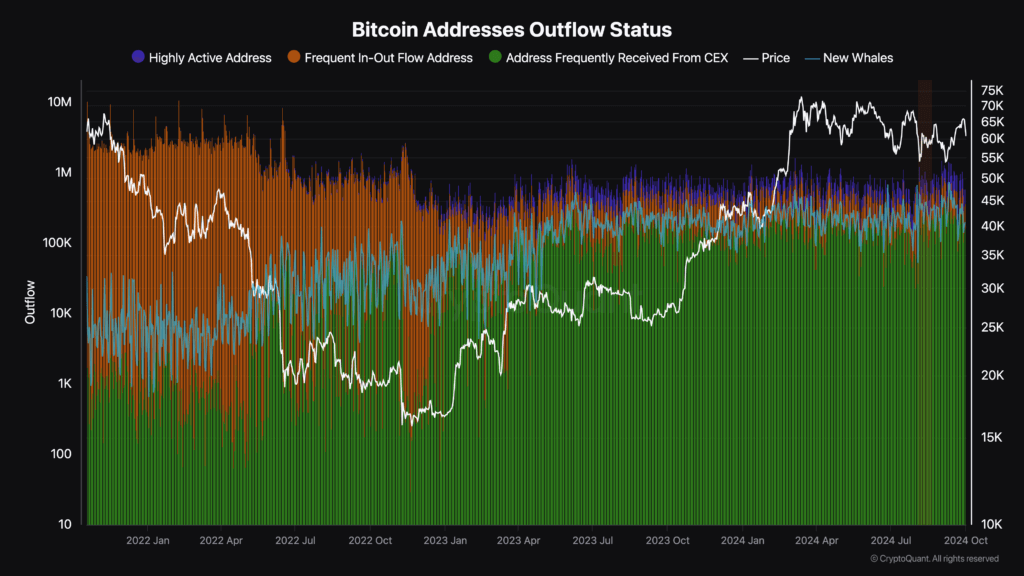

As Bitcoin’s worth declined all through 2022, frequent in-out circulate addresses remained dominant. Nonetheless, their affect weakened after mid-2022, coinciding with a marked improve in addresses often receiving from centralized exchanges. This shift means that extra Bitcoin was shifting by way of or held by trade addresses throughout the restoration interval, indicating elevated buying and selling exercise or investor repositioning in response to market circumstances.

New whale exercise continued to extend throughout the second half of 2022 and into 2023, indicating persistent purchases by massive holders throughout worth lows. This development displays strategic market repositioning during times of heightened market uncertainty. This exercise correlates with Bitcoin’s worth bottoming out in 2022, adopted by a restoration all through 2023 and into 2024.

The rise in new whales during times of decrease costs suggests bullish sentiment, hoping to capitalize on future worth recoveries.

Since 2023, extremely lively addresses have gained traction for the primary time in Bitcoin’s historical past. The event of buying and selling bots, high-frequency buying and selling, and Bitcoin meta layers are partially accountable. The rise in all these addresses showcases Bitcoin’s evolution in utilization and detracts from theories that Bitcoin is changing into nothing greater than a retailer of worth. Bitcoin has core utility world wide, and it’s rising.

Persistent developments in Bitcoin addresses

The prominence of exchange-related addresses throughout particular durations displays modifications in investor habits, resembling shifts towards holding property on exchanges for liquidity or elevated buying and selling exercise in response to market volatility. Equally, the timing of whale exercise suggests that enormous holders affect market developments or reply strategically to cost actions.

The patterns noticed counsel that enormous holders play a major function in market stabilization or development reversals. Their elevated exercise throughout worth lows gives help to the market, doubtlessly stopping additional declines. Conversely, durations of decreased whale exercise may coincide with market uncertainty or consolidation phases.

By monitoring the circulate of Bitcoin throughout totally different deal with classes, we will determine rising developments or shifts in market sentiment. For instance, a surge in exchange-related addresses may sign elevated buying and selling exercise or anticipation of market actions, whereas heightened whale exercise may point out confidence amongst massive traders in future worth appreciation.

The correlation between deal with exercise and worth actions emphasizes the transparency inherent in Bitcoin. Publicly out there on-chain knowledge permits for complete evaluation of market behaviors, providing perception not usually out there in conventional monetary markets. This transparency empowers members to make extra knowledgeable choices primarily based on observable patterns within the community’s transactional exercise.

Finally, analyzing Bitcoin deal with outflow patterns over the previous decade reveals important correlations with market cycles and worth actions. The evolving developments amongst totally different deal with classes echo modifications in market construction, participant habits, and broader adoption developments.

The put up Ten years of Bitcoin deal with knowledge uncovers investor behaviors and market shifts appeared first on cryptoteprise.