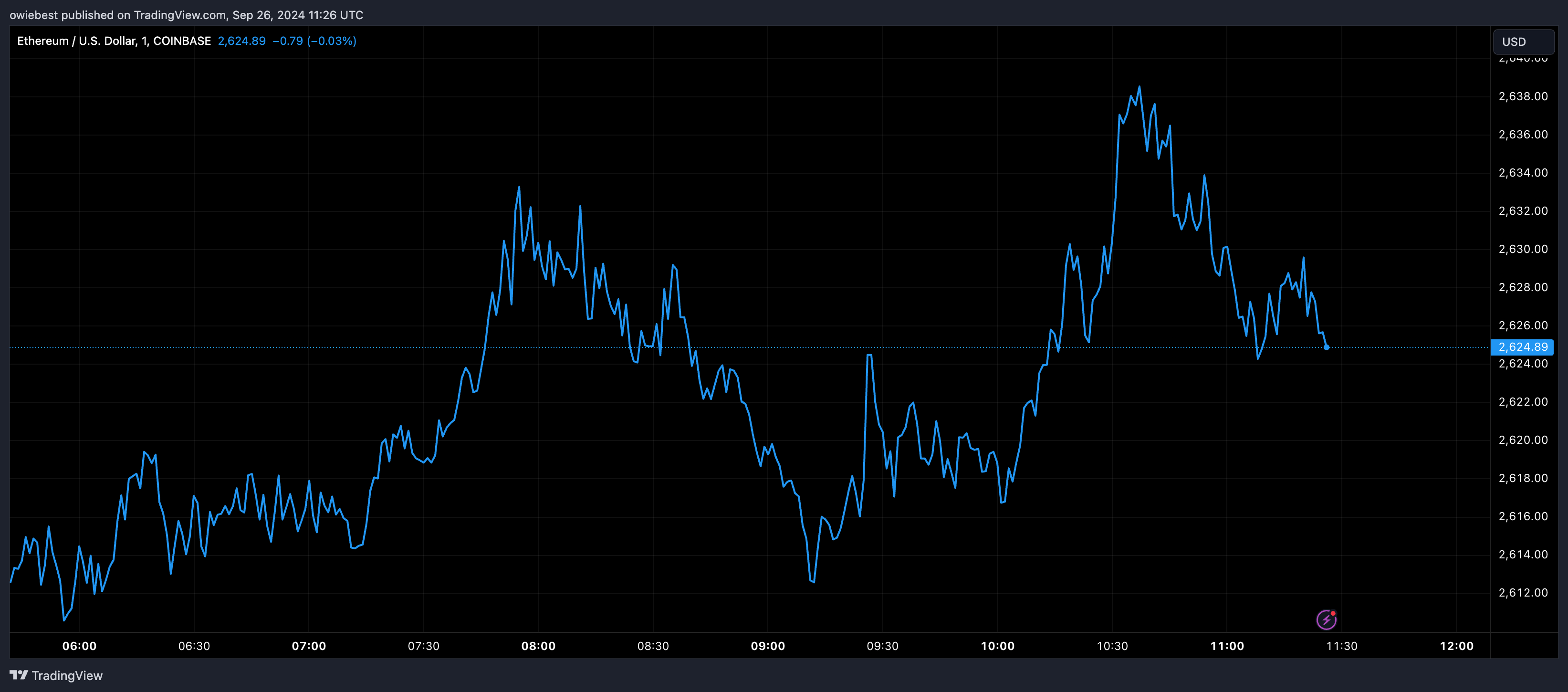

Ethereum, the second-largest cryptocurrency by market capitalization, has but to reclaim the $3,000 value degree since early August. Because the starting of September, Ethereum has largely traded beneath $2,600, however this week introduced a glimmer of hope for traders because it lastly managed to interrupt above the $2,600 threshold.

Now that this resistance threshold has been damaged, the following outlook is a continued surge up till the $3,000 value degree. An evaluation on the CryptoQuant platform factors to a possible catalyst for this transfer to the upside. Notably, this evaluation identifies an rising bullish development in Ethereum’s funding charges as a important catalyst.

Bullish Shift In Funding Charges

Based on an ETH evaluation on CryptoQuant by ShayanBTC, Ethereum’s 30-day shifting common of funding charges has seen a slight however noticeable bullish shift after an prolonged interval of decline. This modification means that merchants are as soon as once more changing into extra assured in Ethereum’s value efficiency, notably after the current Fed rate of interest lower.

ETH Funding charges discuss with the periodic funds made between merchants to take care of the worth of perpetual futures contracts close to the spot value of the cryptocurrency. When the funding charges shift positively, it typically signifies that lengthy positions are extra dominant, which might create upward value strain.

The significance of the funding charges was emphasised by the analyst, particularly contemplating the prospect of a bullish fourth quarter of the yr. Notably, they echoed that for Ethereum to proceed its restoration and goal increased value ranges, the demand within the perpetual futures market should maintain rising within the coming weeks. A small decline within the funding charges may cascade right into a fall in bullish momentum.

Ethereum Staging A Return To $3,000?

Ethereum’s current breakout above $2,600 is the primary sign of a serious shift in market sentiment. After weeks of buying and selling beneath, the $2,600 value degree appears to have now turn out to be a necessary help zone for the cryptocurrency. Curiously, this breakout units the stage for the return of ETH to $3,000, with the funding charges taking part in a necessary half.

On the time of writing, Ethereum is buying and selling at $2,610 and is up by 8% previously seven days. Notably, this value enhance is extra noticeable from a low of $2,171 on September 6, reflecting a 20% enhance since then.

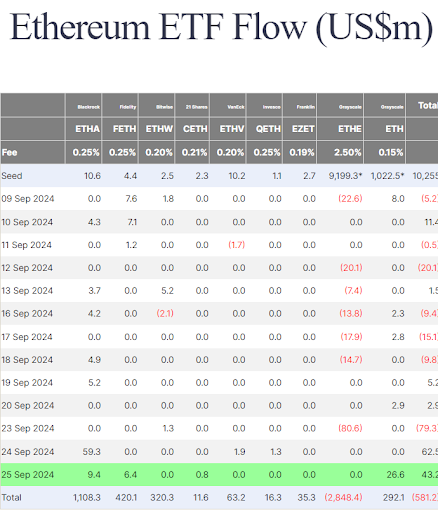

The optimistic sentiment surrounding Ethereum can also be shifting in direction of institutional traders, which is mirrored by way of Spot Ethereum ETFs. Based on move knowledge, the ETFs, which initially began the week with a internet outflow of $79.3 million on Monday, have now witnessed two consecutive days of $62.5 million and $43.2 million, respectively, on Tuesday and Wednesday. The mixture of those inflows may play a major position in whether or not Ethereum can breach the $3,000 value degree and maintain above within the coming weeks.

Featured picture created with Dall.E, chart from Tradingview.com