Bitcoin’s value has surged by 19% in the previous couple of days, pushing it to $64,342. Regardless of this important rise, the cryptocurrency is going through resistance at $65,000.

A key group of traders, recognized for profit-taking at this level, poses a possible risk to the continued bullish momentum. Bitcoin’s rally might reverse if promoting stress escalates, resulting in a decline.

Bitcoin Traders May Guide Earnings

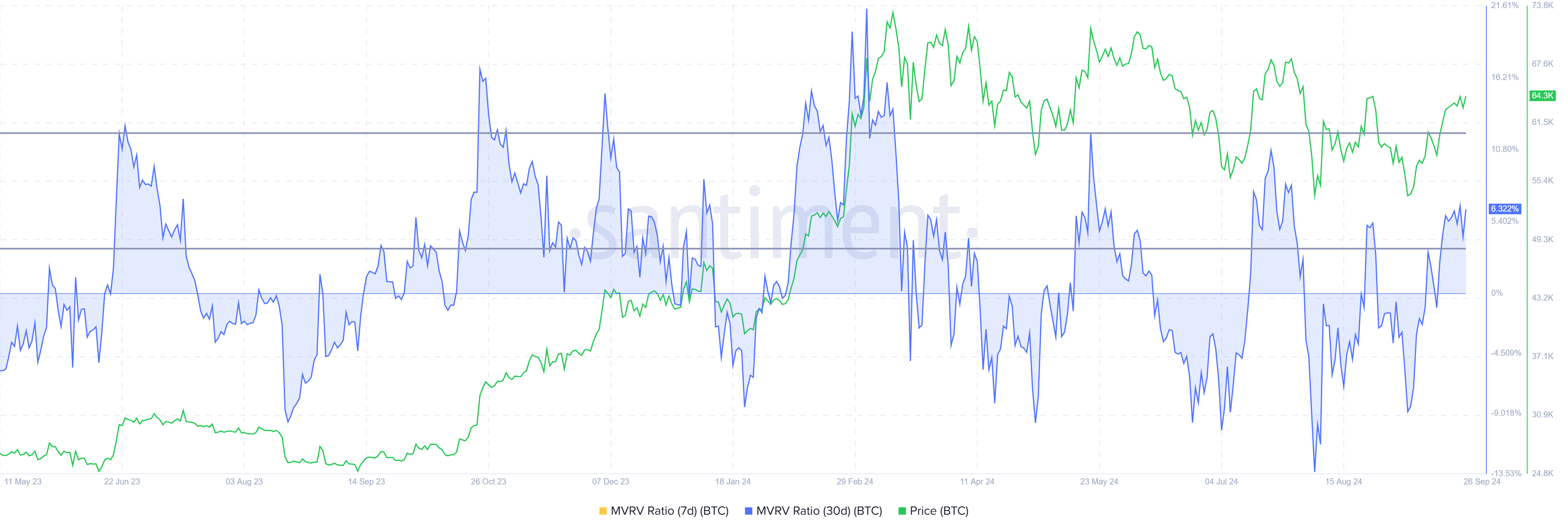

Bitcoin’s value is going through the specter of a correction, largely because of the potential of promoting. Indicators of the identical will be famous within the Market Worth to Realized Worth (MVRV) Ratio.

A key indicator of profitability, this metric has reentered the hazard zone after practically a month. Bitcoin’s 30-day MVRV presently stands at 6.3%, signaling that traders are in revenue.

Traditionally, when the MVRV Ratio ranges between 2% and 12%, it typically triggers promoting stress, resulting in corrections. Traders are inclined to lock in earnings when this threshold is reached, which might result in a decline in Bitcoin’s value.

Learn extra: Bitcoin Halving Historical past: All the things You Want To Know

Bitcoin MVRV Ratio. Supply: Santiment

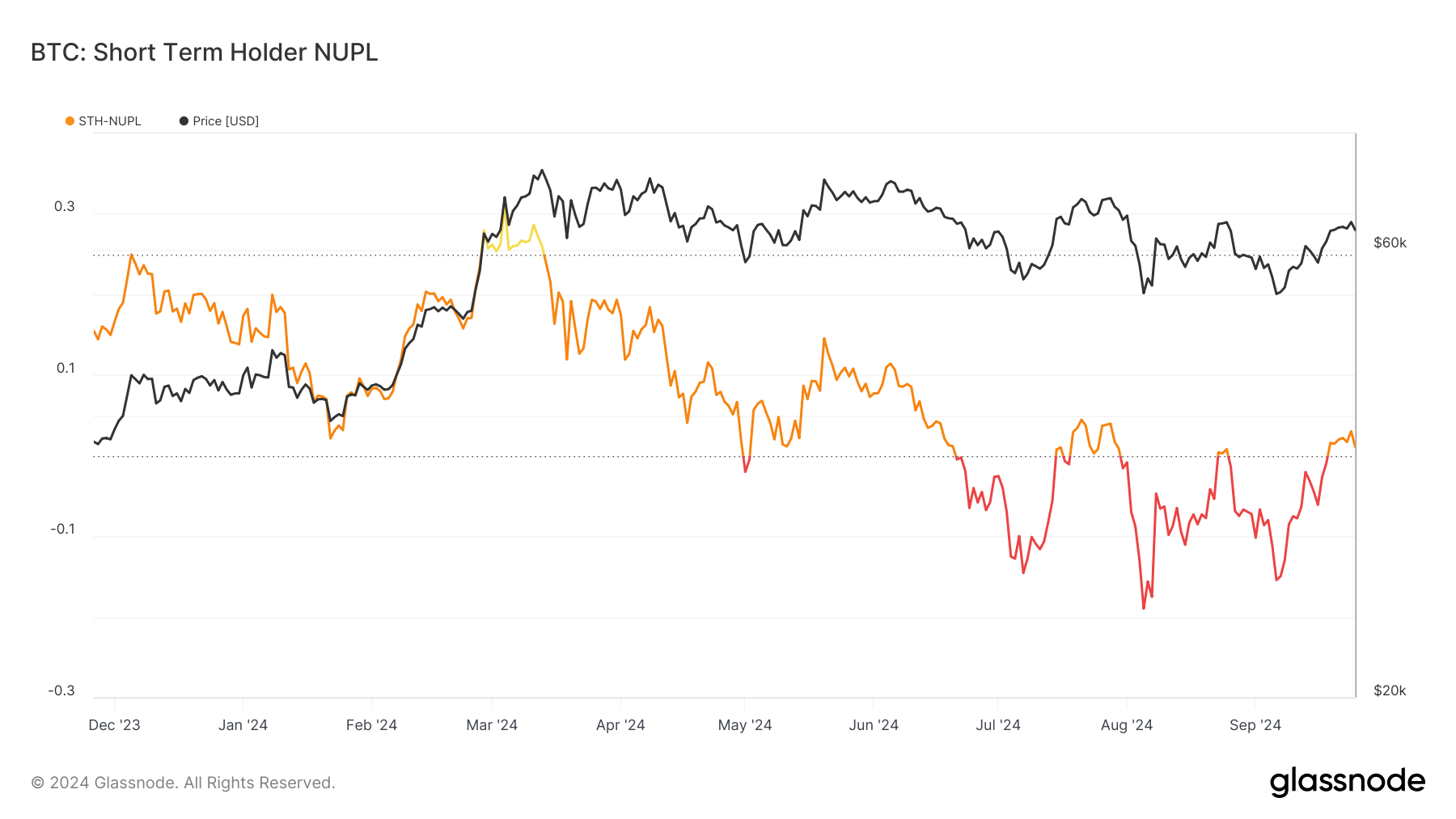

One other essential indicator, the short-term Internet Unrealized Revenue/Loss (NUPL), means that short-term holders are experiencing large unrealized earnings. This group of traders, recognized for holding property for lower than a month, is often fast to promote as soon as earnings accumulate. The NUPL reveals that the bullish momentum has reached a stage the place short-term holders are more likely to begin promoting, growing the chance of a value drop.

Brief-term holders (STH) are anticipated to start liquidating their positions because the bullish sentiment fades above the present threshold. Traditionally, when STH are in revenue and above the brink, they unload their property, placing downward stress on Bitcoin’s value. This makes a possible decline in value extremely possible if this development continues.

Bitcoin STH-NUPL. Supply: Glassnode

BTC Value Prediction: Fall Forward

Bitcoin’s current rise of 19% has introduced its value to $64,342, with $63,068 now performing as essential help. This stage has established itself as a key space the place Bitcoin might discover stability if promoting stress will increase. Nevertheless, regardless of the current beneficial properties, a breach of the $65,000 resistance stage appears unlikely within the close to time period.

If profit-taking intensifies, Bitcoin might drop beneath the $63,068 help, probably falling to $59,666, the subsequent essential help stage. This value flooring might function some extent for Bitcoin to bounce again if promoting stress weakens. Nevertheless, failure to carry this help might result in additional declines.

Learn extra: Bitcoin (BTC) Value Prediction 2024/2025/2030

Bitcoin Value Evaluation. Supply: TradingView

Conversely, if market optimism surrounding October continues, Bitcoin might have an opportunity to breach the $65,000 resistance. A sustained rise above this stage would invalidate the present bearish outlook, probably resulting in additional value will increase and a continuation of the bullish development.