The pinnacle of digital asset analysis at $101.9 billion U.S. hedge fund VanEck, Matthew Siegel, has found and revealed what may very well be key info for these bullish on Ethereum (ETH).

In response to Siegel, Ethereum has regained a major market share of charges among the many fee-based layer-1 blockchains, rebounding from a low 9% share in late August to the present 40%.

Counter to Widespread Sentiment, #Ethereum has Regained Substantial Market Share of Charges Amongst Payment-Incomes L1 Blockchains, Rebounding from a Low of 9% Share in Late August to Attain 40% Immediately. pic.twitter.com/IF9ZIdq3nP

— matthew sigel, recovering CFA (@matthew_sigel) September 23, 2024

For context, the knowledgeable continues, the 20% of layer-1 charges that Ethereum generated in August was the bottom since late 2019. The latter was a “fairly good” time to purchase ETH, in response to Siegel. Apparently, the analyst introduced his micro-research as a departure from the final sentiment towards the key altcoin in the intervening time.

Is “blood within the streets” mode on for Ethereum?

Certainly, when exhausted by Ethereum’s unending decline in opposition to not solely Bitcoin, but additionally its primary competitor proper now, fanatics of the biggest cryptocurrency have already gotten Vitalik Buterin to start out making bullish posts. It’s not simply concerning the value of ETH but additionally concerning the market share amongst blockchains that the identical Solana managed to take for itself this yr.

Presently, even particular person functions like pump.enjoyable on Solana earn extra in per week than your complete Ethereum community.

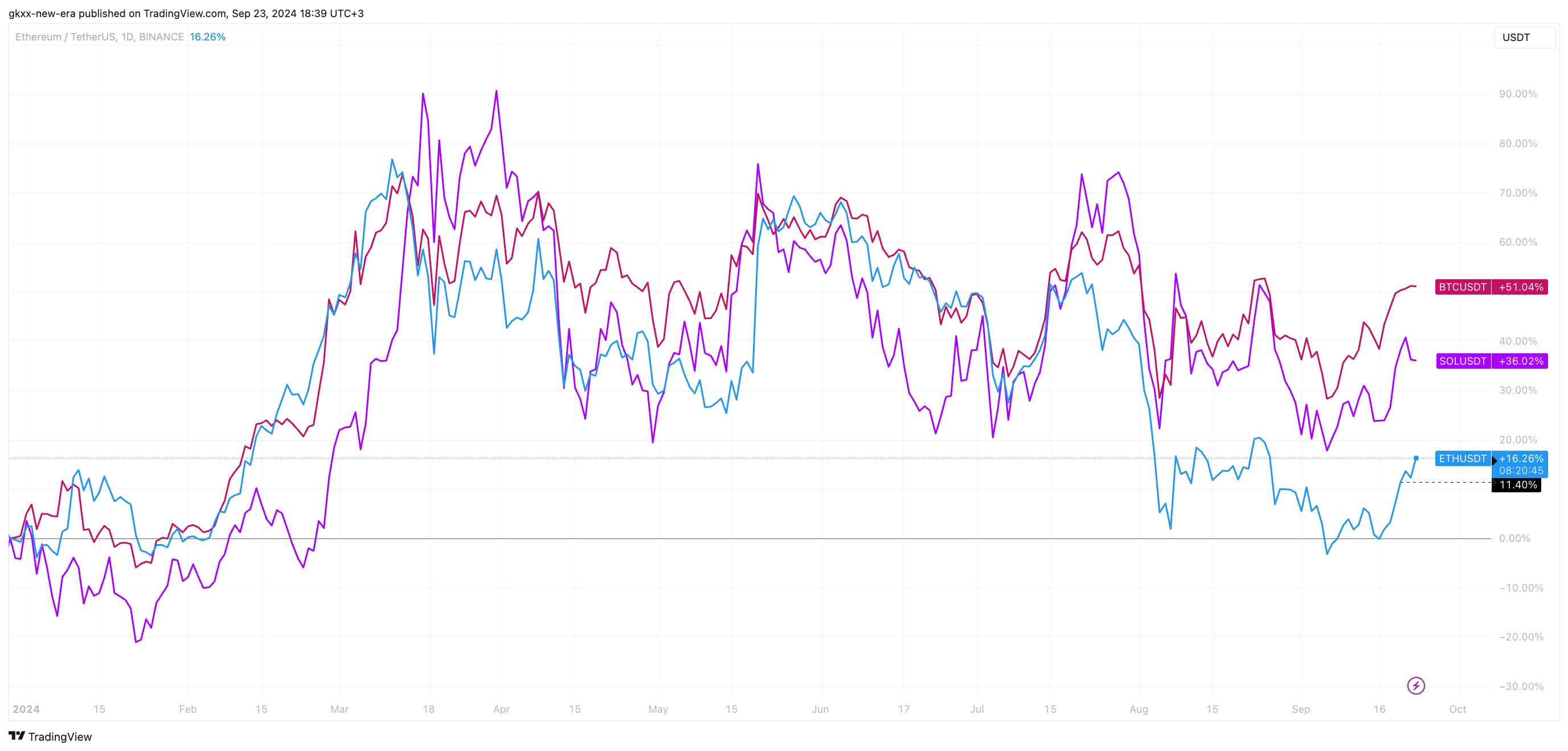

Importantly, Siegel additionally famous how comparable circumstances in 2019 marked the underside of the ETH value. For the reason that starting of 2024, in contrast to Bitcoin and Solana, which have grown their native token costs by greater than 50% and 40%, respectively, the principle altcoin has solely grown by 16.86%, and that was earned within the first three months of the yr.

Who is aware of, perhaps this time historical past will repeat itself and Ethereum will lastly see its renaissance?