NFT Night analysts say 96% of 5,000 NFT collections are lifeless in 2024.

Desk of Contents

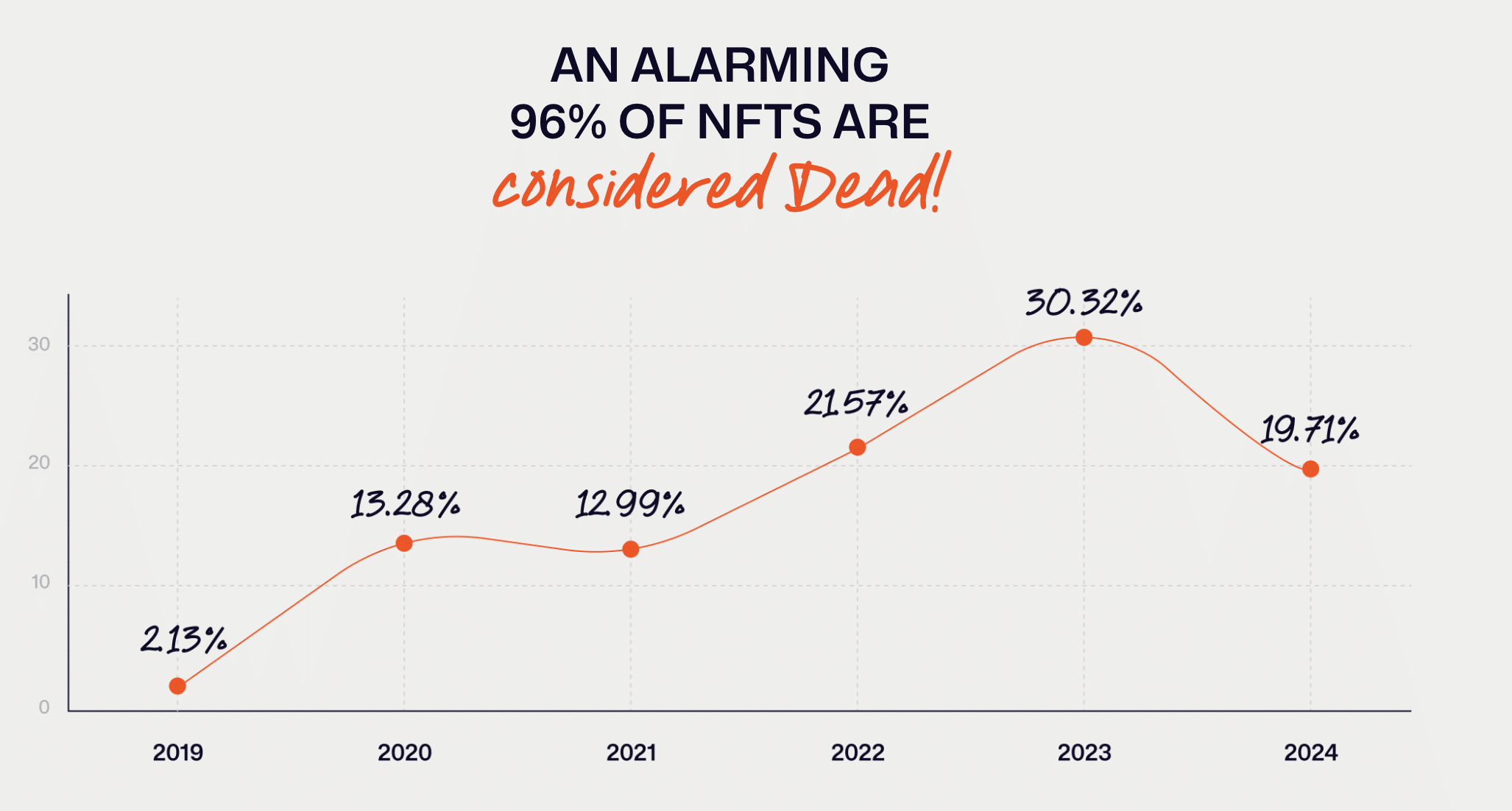

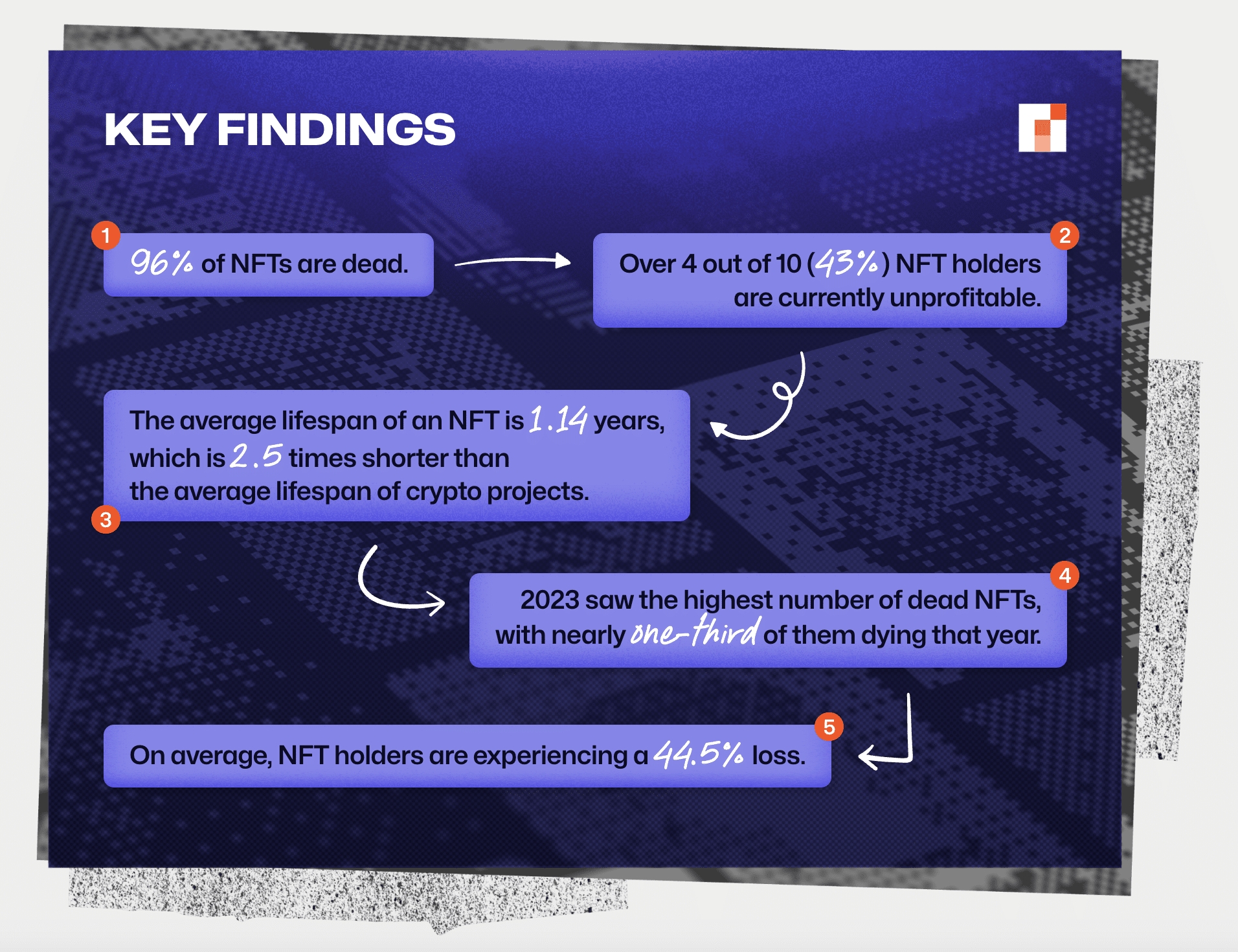

The report reveals the state of the non-fungible token market and its issues in 2024. In line with specialists, 96% of greater than 5,000 current NFT collections are “lifeless.” Because of this they’ve zero buying and selling quantity, no gross sales for greater than seven days, and no exercise on the X social community.

Supply: NFT Night

Analysts be aware that 4 out of 10 NFT house owners at present have to make a revenue from their tokens. On the similar time, the common lifespan of collections is 1.14 years. That is 2.5 occasions lower than the identical indicator for traditional crypto tasks.

As well as, 2023 was a file yr for the variety of NFT collapses. Throughout this era, virtually 30% of tasks from this section fell into the “lifeless” class. In line with specialists, 44.5% of NFT house owners face losses.

Supply: NFT Night

The NFT Night group additionally recognized probably the most worthwhile assortment so far. It turned out to be the Azuki challenge, which, on common, elevated the investments of token house owners by 2.3 occasions.

“This success may be attributed to the gathering’s robust neighborhood engagement, distinctive inventive enchantment, and efficient advertising and marketing methods.”

The specialists additionally talked about probably the most unprofitable NFT assortment — Pudgy Penguins. It skilled a 97% drop in worth, which makes it the present file holder for a lower in proprietor revenue.

Consultants emphasised that the non-fungible token market has declined, and traders within the section should act cautiously. As well as, specialists consider NFT creators ought to rethink their strategy to challenge implementation.

You may additionally like: Pudgy Penguins agency secures $11m to construct new L2 challenge

Finish of an Period

NFTs from well-liked collections purchased on the wave of pleasure in 2022 are offered at colossal losses.

For instance, Arkham Intelligence calculated that NFTs bought by pop star Justin Bieber in 2022 value about $2 million at the moment are value simply over $100,000. The losses reached 94.7%.

Justin Bieber NFT Purchases: Down 94.7%

Do you know that Justin Bieber purchased greater than $2M of NFTs throughout 2022 – now value barely over $100K.

His pockets on Arkham now holds slightly below $500K in ETH and APE.

Particulars under: pic.twitter.com/U6qH84C3OO

— Arkham (@ArkhamIntel) April 24, 2024

The singer’s pockets initially obtained $2.34 million in Ethereum (ETH). Many of the quantity, $1.86 million, went to buy two Bored Ape Yacht Membership (BAYC) and a pair of Mutant Ape Yacht Membership (MAYC). The portfolio additionally included tokens from the World of Ladies, Doodles, Otherdeed, and Metacard collections. Since then, the property have misplaced between 89.7% and 97.4% in worth.

As well as, in August, Deepak Thapliyal, the proprietor of the costliest CryptoPunk #5822, who bought the token for 8,000 ETH ($23.7 million on the time of the transaction) in 2022, removed the asset with out disclosing the sale worth. Amidst the thrill within the sector, the deal turned the fourth costliest amongst all NFTs in 2022.

Finish of an Period.

👋 #5822, Get pleasure from your new 🏡

— Deepak (@dt_nfts) August 19, 2024

The neighborhood suspected that the token was offered at a loss. The client was allegedly consumer X, who goes by the nickname VOMBATUS. The token was reportedly bought for 1,500 ETH (~$3.9 million), 80% cheaper than the earlier worth.

@nftvaluations valued this punk 5k ETH and at present only one alien listed at 5k ETH

In all probability deal closed round 5k ETH pic.twitter.com/lkeuhBdcKr

— SomaXBT (@somaxbt) August 19, 2024

The Rise and Fall of OpenSea

In January 2022, the entire quantity of non-fungible tokens peaked at over $6 billion. As of July 2024, it had fallen under $430 million. NFTs are nonetheless alive, however they’re in a nasty approach.

OpenSea, as soon as the most important NFT market, is in a fair worse scenario, The Verge notes that claims from the Securities and Trade Fee and the Federal Commerce Fee, U.S. and worldwide tax authorities, elevated competitors, allegations of discrimination, and worker layoffs.

As well as, OpenSea‘s valuation fell from $13.3 billion to $1.4 billion after considered one of its largest traders, New York enterprise capital agency Coatue Administration, overvalued its stake within the crypto startup by 90%, from $120 million to $13 million.

Nevertheless, The Verge notes that the corporate nonetheless has some steam left. An inside doc reveals that as of November 2023, OpenSea had $438 million and $45 million in crypto reserves. It expects that with this capital and a brand new enterprise mannequin, will probably be capable of overcome troublesome occasions.

“It had $438 million in money and $45 million in crypto reserves as of November 2023, in response to an inside doc, and it’s coasting on that capital because it hopes a ‘2.0’ pivot will assist it navigate uneven seas.”

You may additionally like: SEC’s regulatory hammer falls: OpenSea, Custodia, and the revival of Operation Choke Level 2.0

What is going to occur to the NFT market?

The NFT market has lengthy been restricted to marketplaces like OpenSea or Rarible, the place customers can challenge new NFTs or commerce them with others.

There are lending providers or platforms for buying and selling derivatives on NFTs from giant collections, permitting customers to take a position on NFTs with out proudly owning them.

Nevertheless, the bearish dynamics within the non-fungible token market persist, as evidenced by the fast decline in costs of NFTs from the blue chip collections.

Learn extra: Magic Eden dominates NFT market as its share nears 37%: CoinGecko