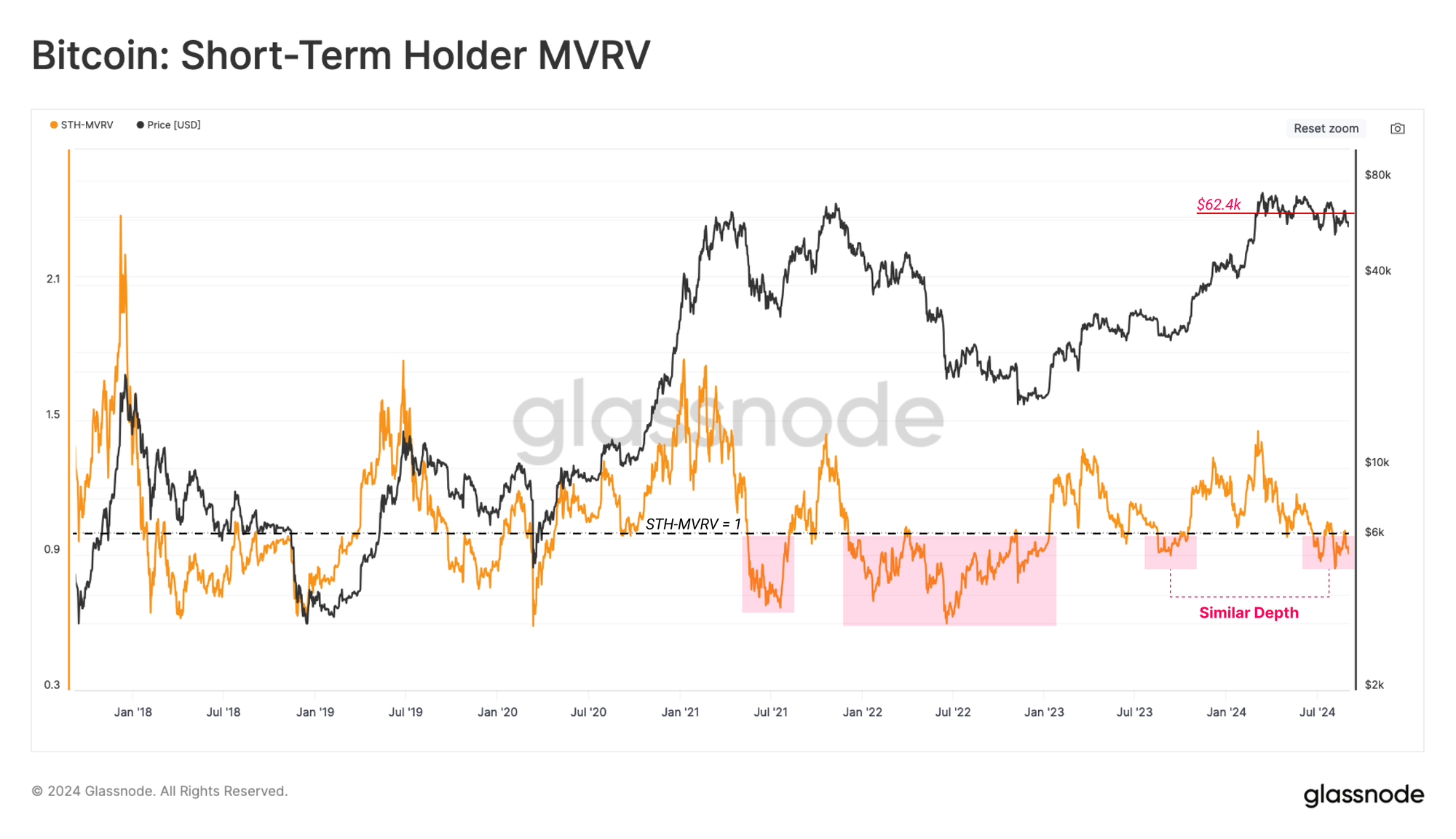

Quick-term holders (STHs) of Bitcoin are feeling ache as BTC falls in value, creating the potential for heightened volatility, based on analytics agency Glassnode.

In a brand new report, Glassnode says that the short-term holder cohort is “closely underwater” of their positions.

“The Bitcoin market has continued to expertise downward stress over current months regardless of the common Bitcoin investor remaining worthwhile general. Nevertheless, the short-term holder cohort stays closely underwater on their holdings, making them a supply of danger in the meanwhile.”

In accordance with Glassnode, short-term Bitcoin holders are a main danger to BTC given they’re considerably underwater and subsequently might be one of many essential sources of promoting stress.

“However, the short-term holder cohort continues to hold elevated unrealized losses, indicating they’re the first cohort in danger and the anticipated supply of sell-side stress within the occasion of a downturn.

Alongside this, revenue and Loss-taking actions stay remarkably gentle, suggesting a saturation of our present vary with important metrics such because the sell-side danger ratio, which alludes to a possible for heightened volatility within the close to future.”

Utilizing the market worth to realized worth (MVRV) ratio, Glassnode says short-term holders current the danger of extra weak point to return for Bitcoin.

The MVRV is the ratio of a crypto asset’s market capitalization relative to its realized capitalization or the worth of all of the cash on the value they have been purchased.

Says Glassnode,

“This tells us that the common new investor is holding an unrealized loss. Usually talking, till the spot value reclaims the STH value foundation of $62,400, there may be an expectation for additional market weak point.”

Supply: Glassnode

At time of writing, Bitcoin is buying and selling at $55,501, up almost 2% on the day.

Generated Picture: Midjourney