Current knowledge suggests Ethereum may gain advantage from diminishing curiosity in Bitcoin (BTC). At press time, ETH’s worth had fallen by almost 2%, just like BTC’s motion.

Nevertheless, throughout this era, market curiosity in ETH has grown, whereas Bitcoin has seen a drop in dealer exercise. This raises the query: is a capital rotation from BTC to altcoins beginning?

Ethereum Positive aspects Floor In opposition to the Quantity One Coin

On August 26, Bitcoin’s open curiosity (OI) stood at over $12 billion. As of now, it has dropped to $11.55 billion, indicating that positions value $500 million have been closed prior to now 24 hours. In distinction, Ethereum’s OI has risen from $5.25 billion yesterday to $5.38 billion immediately.

Open curiosity tracks the move of cash out and in of the crypto market. A rise in OI means merchants are gaining extra publicity to a cryptocurrency by including liquidity to their contracts, whereas a lower alerts decreased internet positioning and capital flowing out of the market.

The current rise in Ethereum’s OI, coupled with Bitcoin’s decline, suggests merchants are shifting their focus from BTC to ETH, searching for higher returns from Ethereum’s worth actions.

Learn extra: Finest Ethereum Wallets To Decide in 2024

Ethereum vs. Bitcoin Open Curiosity. Supply: Santiment

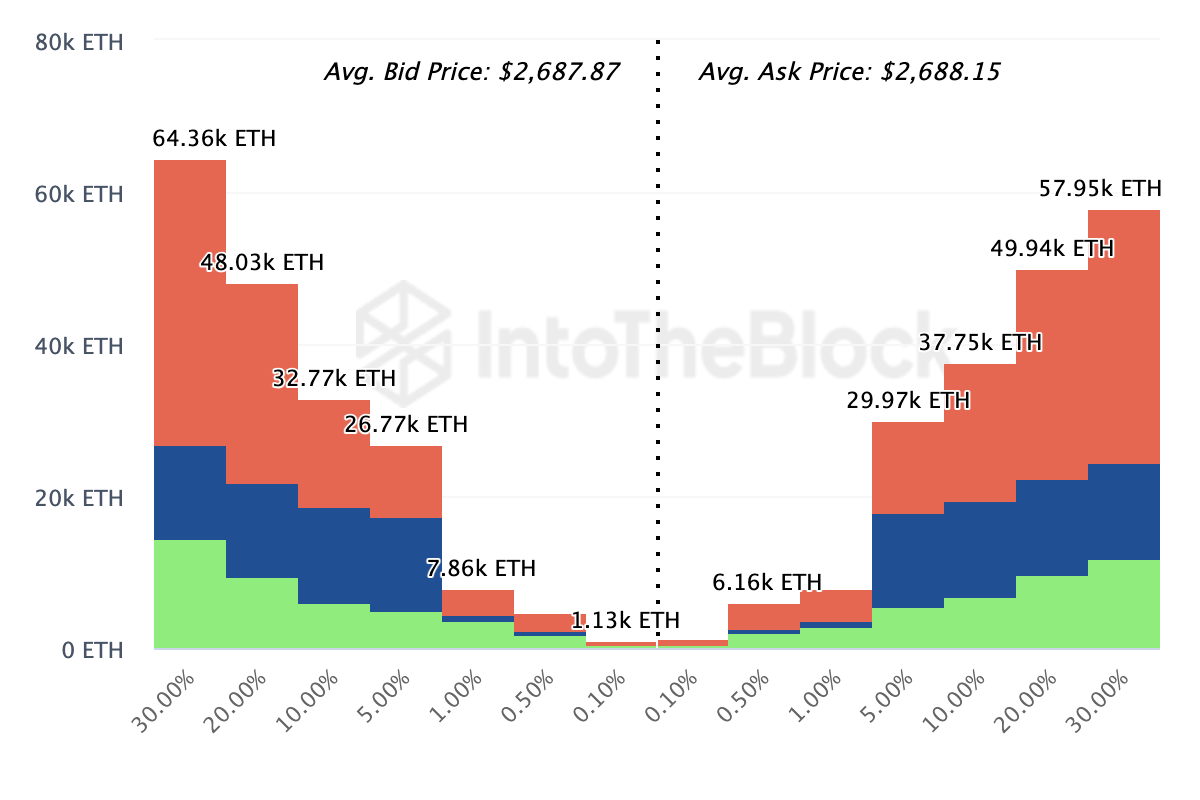

Apparently, this sentiment extends past derivatives market exercise. In accordance with IntoTheBlock, market members are extra inclined to realize publicity to ETH on the spot market quite than rotating capital out of the altcoin.

This development is mirrored within the shopping for and promoting volumes seen on the order books of the highest 20 exchanges. As proven beneath, members are bidding (shopping for) 185,700 ETH, valued at round $2,687 every.

Ethereum Change On-Chain Market Depth. Supply: IntoTheBlock

These cash, value roughly $500 million, barely exceed the amount of these trying to promote. If the bid aspect continues to outpace the ask, ETH’s worth might be poised for a bounce.

ETH Worth Prediction: The $2,800 Resistance Presents Challenges

Ethereum’s every day chart reveals a pointy downtrend in early August, with ETH’s worth falling from $3,392 to $2,109. Nevertheless, in current weeks, the cryptocurrency has entered a consolidation part, indicating a fancy situation the place the market is unsure in regards to the subsequent transfer.

Key help at $2,556 means that ETH might not drop beneath this degree within the brief time period. Moreover, the Commodity Channel Index (CCI) exhibits that ETH’s present worth of $2,647 is considerably beneath its truthful worth.

The CCI measures an asset’s worth relative to its common worth over a given interval. A excessive CCI studying signifies an asset is overvalued, signaling a possible worth drop. Conversely, a low CCI suggests the asset is undervalued, presenting a possible shopping for alternative.

In Ethereum’s case, the CCI’s decline factors to the present worth being beneath its historic common, a comparatively constructive signal that would help a extra optimistic outlook.

Learn extra: Ethereum (ETH) Worth Prediction 2024/2025/2030

Ethereum Day by day Evaluation. Supply: TradingView

For now, ETH would possibly proceed buying and selling sideways. Nevertheless, if the altcoin can overcome the present market hesitation in shopping for giant volumes, it might problem resistance at $2,810, probably break the $3,000 barrier, and intention for $3,360.

On the flip aspect, failure to interrupt by the overhead resistance might invalidate the bullish outlook for ETH. In that situation, ETH’s worth would possibly retest decrease help ranges round $2,556.