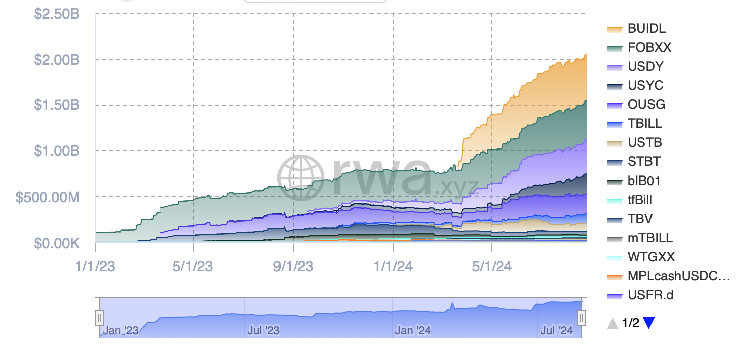

Tokenized Treasury notes handed $2 billion in market cap after speedy development from Blackrock’s BUIDL and different issuers.

This comes solely 5 months after the funds hit the $1 billion milestone in March.

Lower than 5 months after hitting $1 billion in market capitalization, tokenized Treasury notes have doubled in measurement once more, crossing the $2 billion degree on Saturday, in accordance with knowledge from RWA.xyz.

Tokenized Treasuries are digital representations of U.S. authorities bonds that may be traded as tokens on blockchains akin to Ethereum, Stellar, Solana, Mantle and others. Whereas $2 billion is a formidable milestone for the not too long ago launched funds, there’s much more potential given the Treasury market’s large measurement of $27 trillion.

The most important one, BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL), is an enormous issue on this 12 months’s hovering market cap. ust six weeks after its late March launch, BUIDL turned the biggest tokenized Treasury fund at $375 million in market cap. Belongings now stand at $503 million. Rivals embody Franklin Templeton’s OnChain U.S. Authorities Cash Fund (FOBXX) and Ondo’s U.S. Greenback Yield (USDY), each of which have additionally seen explosive development.

Many of the latest development, nevertheless, got here from smaller issuers, rwa.xyz knowledge exhibits. Hashnote’s providing mushroomed practically 50% to hit $218 million over the previous month. In the meantime, OpenEden’s and Superstate’s merchandise grew 37% and 18%, respectively, throughout the identical interval, each nearing $100 million market cap.

Tokenized Treasury funds have develop into a well-liked funding automobile for crypto merchants seeking to diversify their holdings and make the most of the speedy rise in Treasury yields over the previous few years whereas additionally having the ability to settle transactions at any time.

The 10 12 months U.S. yield at the moment stands at 3.81% versus 1.5% 4 years in the past. Equally, the 2 12 months yield has risen to three.92% up from close to zero ranges in 2020 and 2021.