In 2024, the NFT market confronted an surprising downturn, revealing difficult patterns because the once-booming sector struggled to keep up its momentum.

A latest research by NFTEvening and Storible company, analyzing the efficiency of 29,079 new NFT collections, presents a stark actuality. It reveals that the majority NFT drops this yr are failing to seek out lasting worth or engagement.

Revenue Elusive in 2024 NFT Market as Most Drops Decline

Utilizing knowledge from Dune Analytics and OpenSea, NFTEvening and Storible’s analysis centered on collections launched between January and August 2024. The research confirmed outcomes Utilizing OpenSea’s API and analyzed key metrics. Amongst them are minting and buying and selling volumes, worth actions, and buying and selling exercise to evaluate general market well being.

Per the analysis, practically 98% of 2024’s NFT initiatives are successfully “lifeless.” This implies they’ve skilled little or no buying and selling exercise since September. The excessive failure price suggests that the majority new initiatives lose relevance shortly after launching, pointing to an oversaturation of the market.

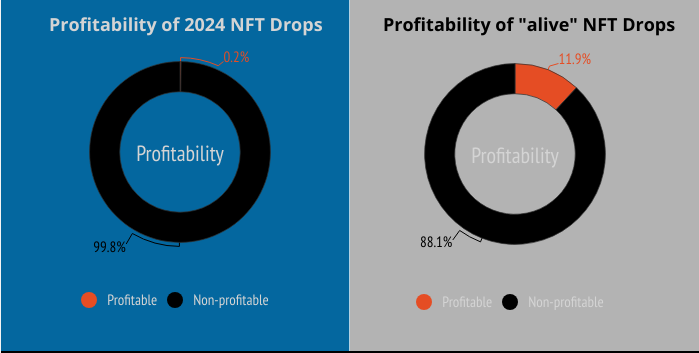

Additional, solely 0.2% of 2024 NFT drops have profited their buyers. Even amongst “alive” NFTs that also see some buying and selling exercise, simply 11.9% have been worthwhile. This displays the challenges creators face in delivering funding returns within the present local weather.

Regardless of the abundance of recent collections, the report additionally notes that over 64% of 2024 NFT drops have been recorded in fewer than 10 minutes. This turnout signifies problem in attracting preliminary consumers. Additional compounding the issue, 98% of those initiatives noticed fewer than 10 trades inside their first week. This turnout suggests a extreme lack of market curiosity and investor confidence.

One other discovering within the analysis is that an awesome 98% of 2024 drops noticed their costs fall by not less than 50% inside simply three days of launch. This fast devaluation highlights how shortly purchaser enthusiasm wanes. It additionally means that the NFT market could now not help speculative buying and selling because it as soon as did.

State of 2024 NFT Drops. Supply NFTEvening

There’s alsolimited worth progress, with round 84% of those initiatives hitting an all-time excessive worth equal to their mint worth. This implies they failed to understand in worth. The shortage of worth progress displays the broader cooling sentiment in a market that after thrived on hypothesis and excessive liquidity.

These findings mirror the market’s vital hurdles because it contends with an overflow of recent collections, every vying for a restricted pool of lively consumers.

Oversaturation, Lack of Curiosity, and Future Instructions for NFT Creators

One key takeaway from the report is the oversaturated nature of the 2024 NFT market. With a mean of three,635 NFT collections created month-to-month, provide has far outpaced demand. This makes it more and more troublesome for brand spanking new initiatives to realize traction. The sharp decline in minting and buying and selling exercise indicators a rising disconnect between creators and collectors, elevating questions in regards to the sustainability of an overcrowded market.

Along with the NFTEvening report, BeInCrypto just lately printed findings that echo the oversaturation situation. It famous a “lifeless challenge” phenomenon. This factors to an identical pattern, the place an awesome variety of NFTs fail to keep up relevance or buying and selling quantity after launch. It means that the market is flooded with initiatives which are unable to ship lasting worth.

The hole between profitable and failing collections, in addition to variations in challenge lifespan, reveal that the NFT market is now not the golden goose it as soon as gave the impression to be.

Because the NFT market turns into tougher, creators and challenge groups are at a crossroads. To outlive, initiatives should supply greater than easy collectibles. Constructing a sustainable, engaged neighborhood, offering real utility, and fostering long-term worth has change into important for standing out. As fast drops and “flip” tradition lose their attraction, a shift towards community-oriented and utility-based NFTs could change into the usual.

In the meantime, buyers should train warning and totally vet initiatives to keep away from losses in a market the place profitability is more and more elusive.