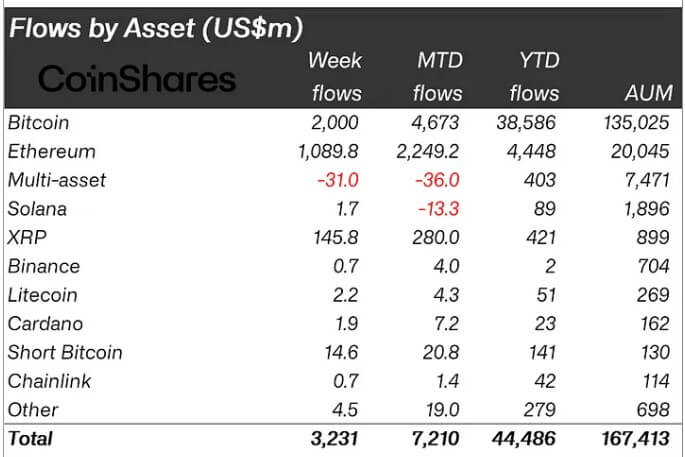

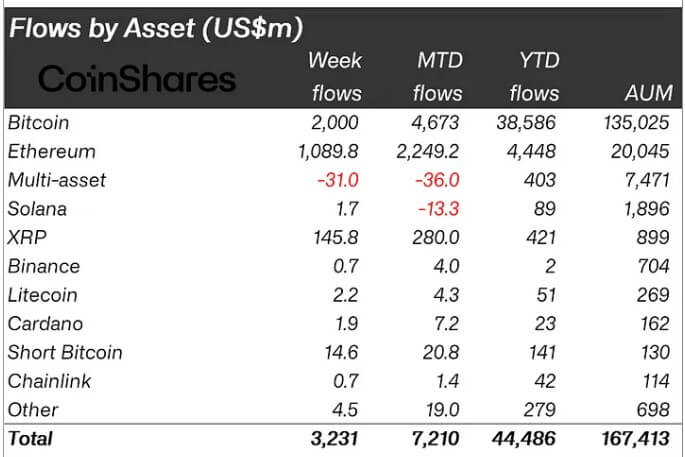

CoinShares’ newest report confirmed that the crypto sector skilled $3.2 billion in influx final week, extending its streak to 10 consecutive weeks of constructive flows. This marks the longest streak of influx this yr.

The influx additionally brings complete year-to-date flows to $44.5 billion, which is 4 occasions increased than any earlier annual report.

Trump’s election victory spur $11 billion influx

Final week, Bitcoin-related funding merchandise noticed inflows totaling $2 billion. This implies the flagship digital asset has recorded over $11 billion in inflows since Donald Trump‘s election victory in November.

The sturdy post-election momentum in Bitcoin ETPs is primarily attributed to optimism round potential regulatory readability and a extra crypto-friendly stance from the incoming US administration. This has led the US market to dominate inflows, contributing $3.1 billion, adopted by Switzerland ($36 million), Germany ($33 million), and Brazil ($25 million).

CoinShares’ Head of Analysis, James Butterfill, famous that buying and selling volumes in Bitcoin ETPs averaged $21 billion weekly, accounting for 30% of Bitcoin buying and selling exercise on trusted exchanges. Bitcoin volumes on these exchanges reached $8.3 billion each day, showcasing a liquid and strong buying and selling surroundings.

In the meantime, quick Bitcoin merchandise additionally gained traction, with inflows of $14.6 million pushing their belongings below administration to $130 million. This development highlights rising curiosity in hedging methods as Bitcoin’s value climbed to an all-time excessive of over $106,000.

Ethereum maintained its streak of inflows, marking its seventh consecutive week with $1 billion added. Over this era, Ethereum ETPs noticed complete inflows attain $3.7 billion, underlining improved sentiment.

Notably, spot Ethereum ETFs reported a 15-day influx streak, capturing over $2 billion throughout the reporting interval.

Altcoins additionally skilled constructive momentum. XRP drew $145 million in inflows, fueled by hypothesis a few potential US-listed ETF. In the meantime, Polkadot and Litecoin recorded $3.7 million and $2.2 million in inflows as buyers diversified their portfolios.

Bitcoin Market Knowledge

On the time of press 12:37 pm UTC on Dec. 16, 2024, Bitcoin is ranked #1 by market cap and the value is up 0.89% over the previous 24 hours. Bitcoin has a market capitalization of $2.05 trillion with a 24-hour buying and selling quantity of $67.56 billion. Study extra about Bitcoin ›

Crypto Market Abstract

On the time of press 12:37 pm UTC on Dec. 16, 2024, the overall crypto market is valued at at $3.65 trillion with a 24-hour quantity of $172.84 billion. Bitcoin dominance is at present at 56.29%. Study extra in regards to the crypto market ›

Talked about on this article