MicroStrategy inventory value has dropped 27% from its highest degree this 12 months, regardless of Bitcoin reaching a document excessive.

MSTR shares had been buying and selling at $390 on Dec. 6, persevering with a decline that started on Nov. 21, when the inventory peaked at $541. Even with this pullback, MicroStrategy stays one of many best-performing shares this 12 months, up over 500%, with a market cap exceeding $91 billion. It is usually the highest gainer within the Russell 2000 index.

There are two attainable the reason why the inventory has retreated this month. First, this decline is due to profit-taking amongst traders who’ve benefited from its climb.

Second, traders are possible involved about its valuation, which stands at about $91 billion. This can be a large premium contemplating that MicroStrategy holds 402,100 cash valued at beneath $40 billion. As such, there’s a $50 billion hole that can’t be stuffed by the struggling unique knowledge analytics enterprise.

You may also like: Bitcoin value can hit $200k in 2025, however crossing $122k might be essential

Subsequently, some traders imagine that the corporate’s valuation will in the end drop to convey its valuation near its Bitcoin (BTC) holdings.

Nonetheless, most Wall Road analysts are optimistic that the inventory has extra upside left. In keeping with Yahoo Finance, a few of the most bullish analysts are from Cowen, Barclays, Benchmark, and Bernstein. The typical estimate for the inventory is $492, increased than the present $390.

MicroStrategy’s inventory has additionally mirrored the efficiency of different Bitcoin-exposed firms. Marathon Digital, the second-largest Bitcoin holder, has declined 14% from its November peak, whereas Coinbase, Riot Platforms, and Hut 8 Mining have additionally skilled pullbacks.

What subsequent for MSTR inventory?

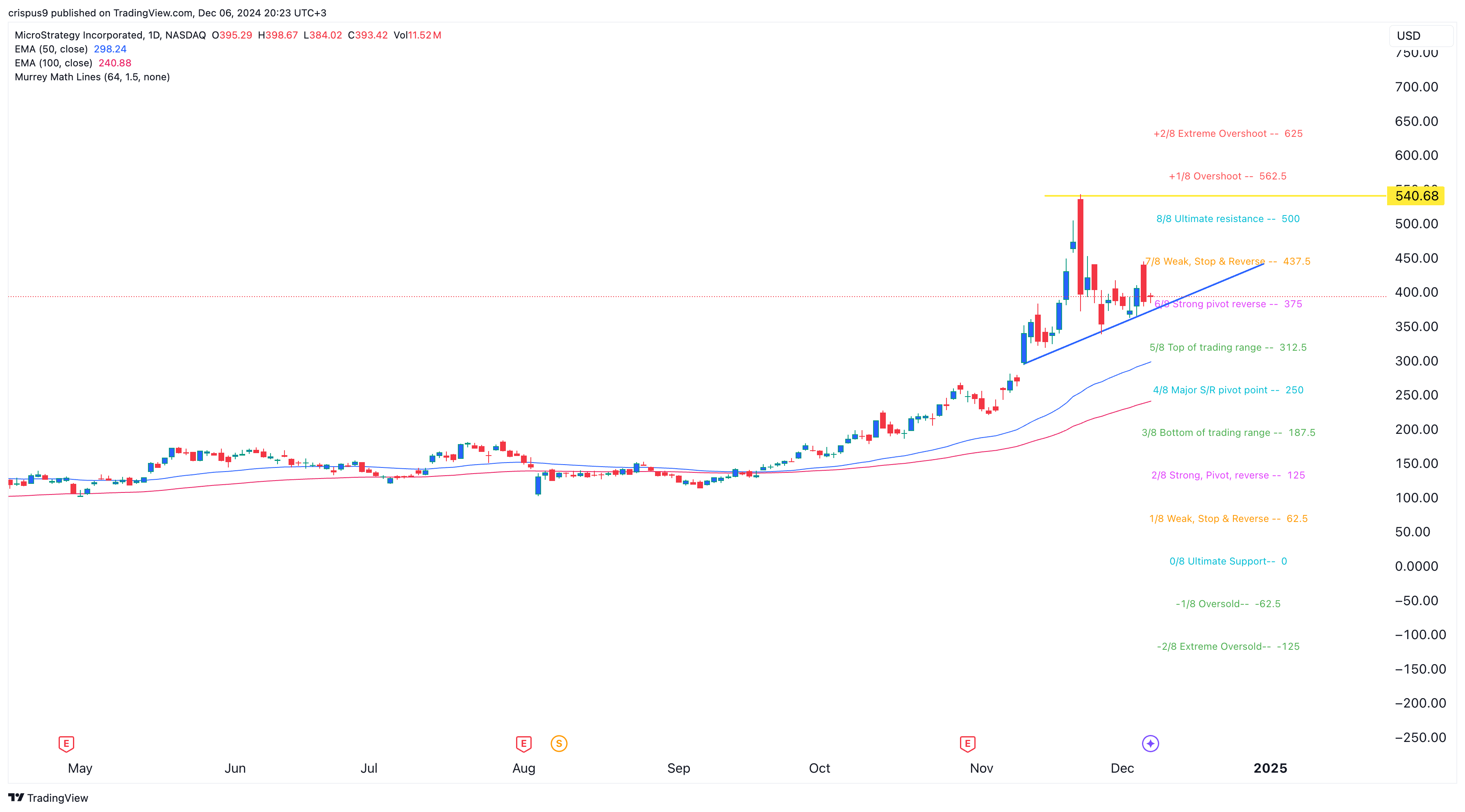

MSTR inventory chart | Supply: TradingView

MicroStrategy’s inventory has pulled again however stays above the ascending trendline connecting the bottom swings since Nov. 11. It is usually buying and selling above the 50-day and 100-day transferring averages, suggesting potential help for additional positive aspects.

It has additionally bottomed on the sturdy pivot reverse level of the Murrey Math Strains instrument. Subsequently, the inventory will possible bounce again if Bitcoin continues rising, as analysts anticipate.

If this occurs, the inventory will possible proceed rising as bulls goal the all-time excessive of $540. A break above that degree will level to extra positive aspects, probably to the intense overshoot degree at $625.

Conversely, a drop under the rising trendline may see the inventory have a imply reversal and drop to the 100-day transferring common at $240. This value coincides with the main S&R degree of the Murrey Math Strains.

You may also like: Can Shiba Inu and Pepe costs rise to $1 in 2025?