Blockchain know-how is quickly remodeling industries far past cryptocurrencies, providing unparalleled transparency, safety, and effectivity. This innovation has made blockchain shares—shares in firms that develop or combine blockchain know-how—extremely engaging to savvy buyers.

Quite a few firms leverage blockchain to boost their operations, ship cutting-edge companies, or spearhead developments within the cryptocurrency sector. Whereas some firms are devoted fully to blockchain and cryptocurrency innovation, others combine blockchain to bolster their present, profitable enterprises.

Recognizing this dynamic potential, Finbold has pinpointed two standout shares with robust purchase rankings, promising so as to add important worth to any funding portfolio via publicity to distributed ledger applied sciences

Mastercard Included (NYSE: MA) inventory

Mastercard Included’s (NYSE: MA) modern method to blockchain has earned it a spot on Forbes’ 2023 Blockchain 50 record, underscoring its aggressive pursuit of distributed ledger know-how.

Mastercard has been actively concerned in exploring and adopting blockchain know-how via a number of key initiatives. The Mastercard Multi-Token Community (MTN), launched in 2023, is a blockchain-based platform designed to make transactions inside digital asset and blockchain ecosystems safer, scalable, and interoperable.

Moreover, Mastercard is actively concerned in trials and discussions relating to Central Financial institution Digital Currencies (CBDCs), providing experience and steerage to governments exploring CBDC implementation, as introduced by the corporate.

The corporate additionally runs the Begin Path Crypto Program,which fosters innovation by supporting startups within the blockchain and digital asset house, serving to them scale their companies whereas prioritizing options which are energy-efficient and promote a optimistic social influence.

Mastercard boasts a market cap of $406.96 billion and has demonstrated sturdy monetary well being, producing $25.7 billion in income over the previous yr and incomes $11.85 per share.

The corporate provides a dividend of $2.64 per share with a powerful development fee of 15.91% year-over-year, making it engaging for each development and income-focused buyers.

Analyst confidence is excessive, with a consensus worth goal of $524.50, representing an 18.89% upside from the present worth of $441.16. Mastercard’s strategic acquisitions, robust money stream, and steady innovation place it nicely for sustained development, making it a compelling purchase.

Riot Blockchain, Inc. (NASDAQ: RIOT) inventory

Riot Blockchain (NASDAQ: RIOT) is a outstanding participant within the Bitcoin mining sector, repeatedly increasing its capabilities to capitalize on blockchain know-how’s potential. Riot not too long ago signed a deal to buy 31,500 next-generation miners from MicroBT, boosting its self-mining hash fee from 12.4 EH/s to fifteen.1 EH/s by the tip of July.

Moreover, Riot’s Corsicana Facility, now the world’s largest Bitcoin mining web site with a developed capability of 1 GW, additional enhances its mining capability as introduced by the corporate.

Financially, Riot has proven robust efficiency, reporting $79.3 million in income, up from $73.2 million final yr, and attaining a web earnings of $211.8 million, or $0.82 per share, pushed by a 131% rise in Bitcoin (BTC) costs.

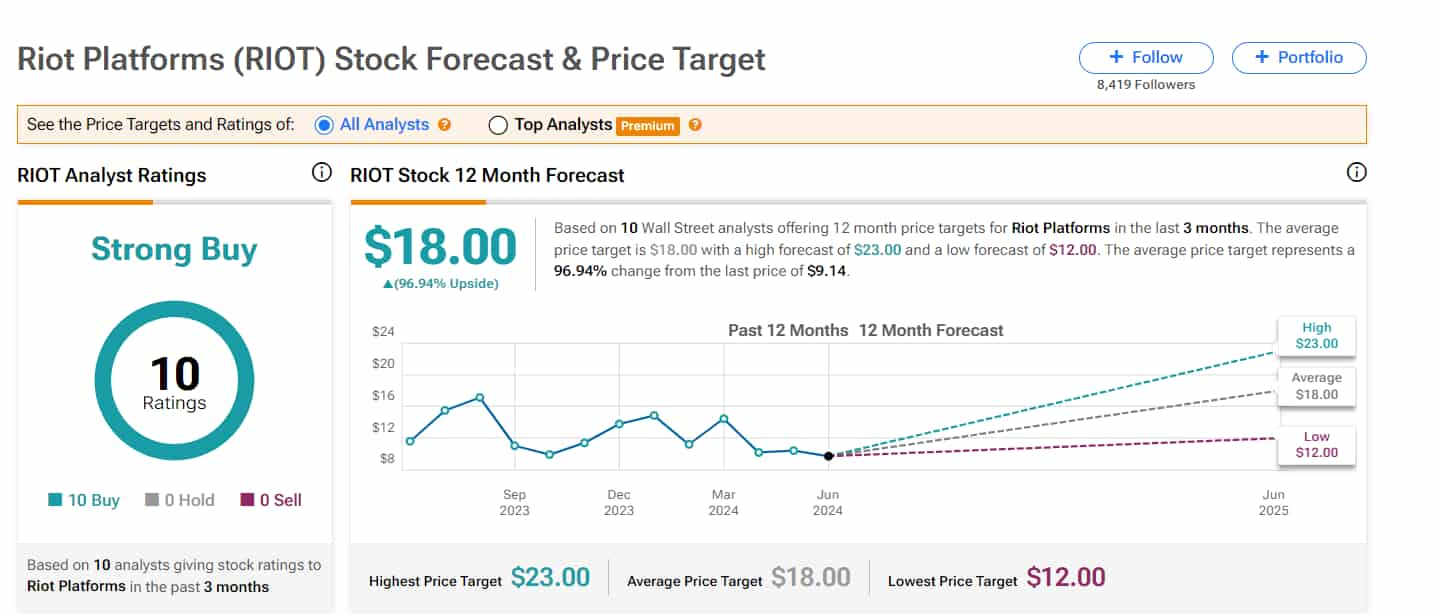

Analysts are extremely optimistic about Riot’s future, with a median worth goal of $18, indicating a considerable 96.94% improve from the present worth of $9.14. Riot’s aggressive growth and funding in superior know-how make it a lovely choice for buyers seeking to capitalize on the expansion of blockchain know-how.

Mastercard and Riot Blockchain are on the forefront of blockchain innovation of their respective sectors, making them compelling funding alternatives for July 2024. Mastercard’s integration of blockchain into monetary companies, mixed with its robust monetary efficiency and strategic initiatives, positions it as a dependable long-term funding.

Riot Blockchain’s increasing mining operations, robust monetary metrics, and important development potential underscore its worth as a high-growth funding. These shares are well-positioned to leverage the transformative energy of blockchain, offering buyers with alternatives for substantial returns.

Nonetheless, buyers ought to stay cautious and conduct thorough analysis as a result of inherent volatility and dangers of inventory markets

Disclaimer: The content material on this web site shouldn’t be thought of funding recommendation. Investing is speculative. When investing, your capital is in danger.