Because the week ended on Friday, June 14, the cryptocurrency market crashed, with altcoins reaching multi-month lows. In the meantime, a agency has proven a bullish bias and purchased this latest dip, allocating practically $20 million to 2 cryptocurrencies.

The cryptocurrency buying and selling agency Amber Group has disclosed over $1 trillion in buying and selling quantity since 2017, with hundreds of purchasers. In 2022, Amber Group had an estimated $5 billion in belongings underneath administration (AUM) completely devoted to cryptocurrency. In response to a Blockworks report, the corporate was valuated at $3 billion throughout a non-public funding spherical, disclosing some numbers.

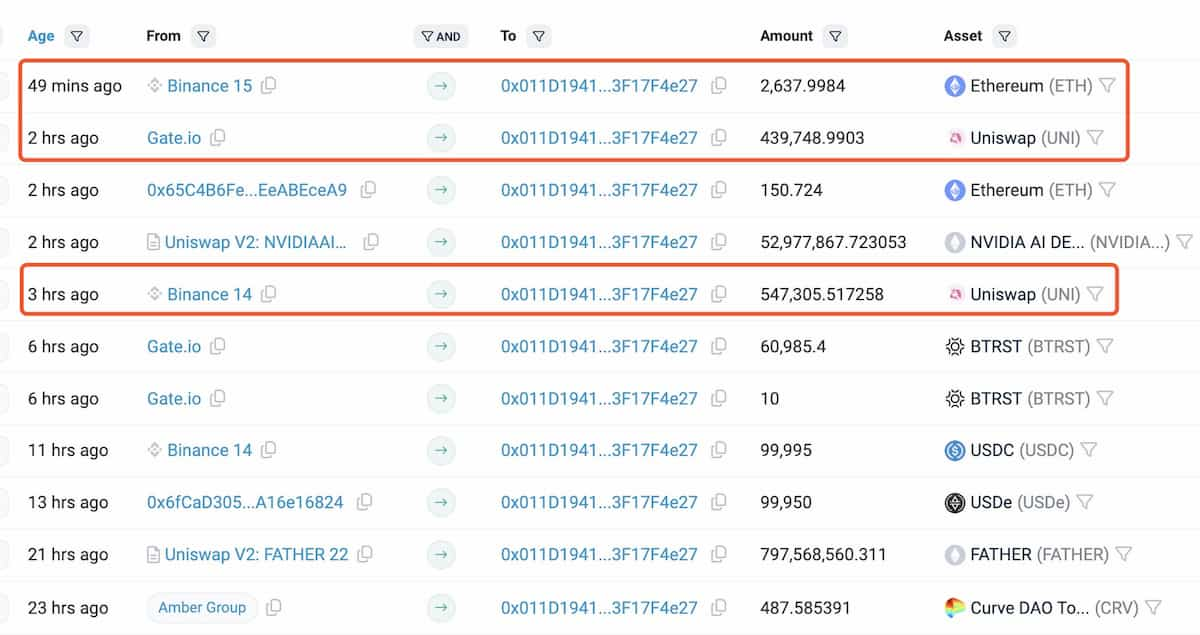

Now, Lookonchain noticed and reported on-chain knowledge that exhibits addresses associated to the Amber Group aggressively shopping for the dip. Particularly, the pockets withdrew practically $20 million of Ethereum (ETH) and Uniswap (UNI) from exchanges, suggesting a place commerce.

Amber Group buys the dip, bets on Ethereum and Uniswap

Notably, the Amber Group-related handle ‘0x011d19410fc79f140c08ffa8301e4153f17f4e27‘ withdrew 2,638 ETH from Binance, price $9.2 million, as Lookonchain reported.

The Uniswap token place, nevertheless, was made with two withdrawals. Considered one of 547,305 UNI from Binance and 439,749 UNI from Gate.io, totaling 987,054 UNI, price $10.6 million.

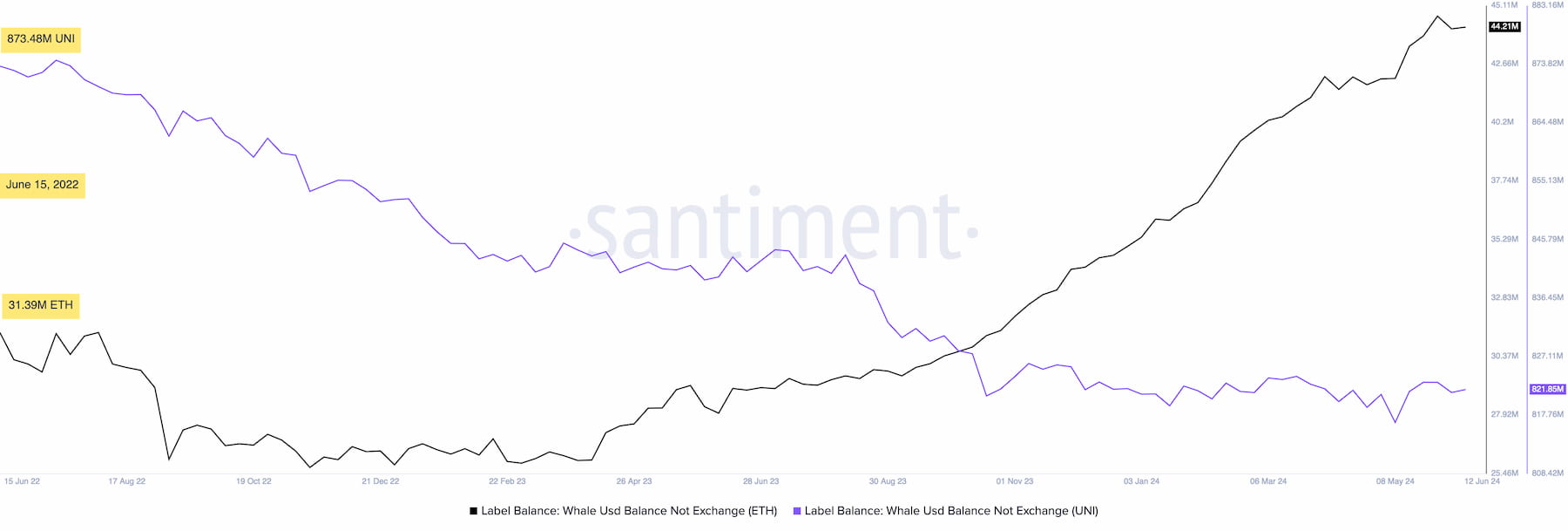

On this context, Finbold retrieved knowledge from Santiment analyzing whales’ habits on Ethereum and Uniswap during the last two years. Apparently, Uniswap whales have been dumping their tokens over this era whereas Ethereum whales are accumulating.

Since June 15, 2022, whales have added 12.82 million ETH to their balances whereas eradicating 51.63 million UNI.

As of this writing, Ethereum trades at $3,534, recovering from a dip to $3,376, and Uniswap trades at $10.92, up from $10.24 on June 14. The present crash was ETH’s lowest worth month-to-date, whereas UNI had a month-low at $8.84 on June 11.

Within the meantime, concern nonetheless dominates retail sentiment amongst technical and social indicators, which indicators a market divergence and asymmetry. Whales and institutional gamers like Amber Group consider this can be a nice alternative to purchase, which may quickly repay.

Disclaimer: The content material on this web site shouldn’t be thought-about funding recommendation. Investing is speculative. When investing, your capital is in danger.