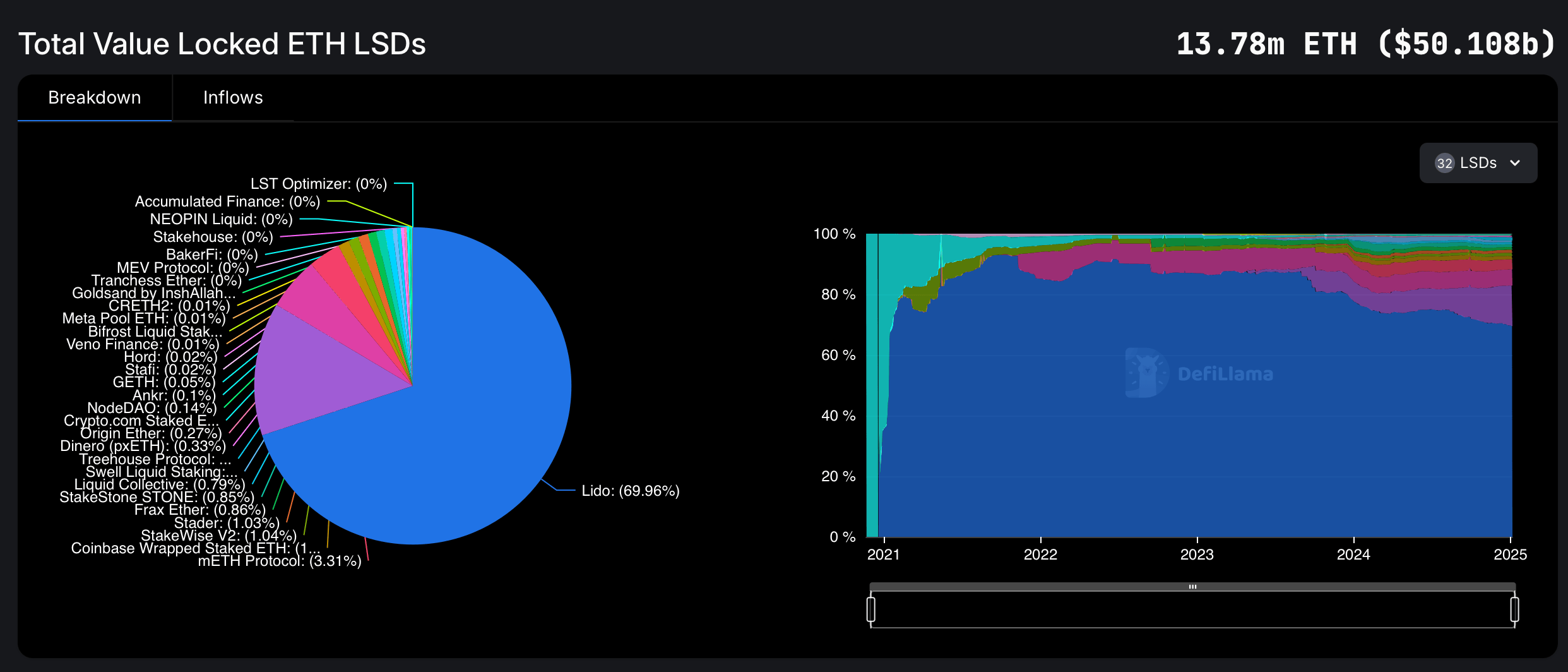

In October 2024, the quantity of ethereum locked into liquid staking platforms surpassed the 14 million ether threshold. Nonetheless, as of 2025, the overall ETH held in these protocols has fallen beneath the degrees recorded on the finish of November. As of Sunday, Jan. 5, 2025, roughly 13.78 million ether stays tied up in liquid staking platforms.

Lowering Confidence? Liquid Staking Platforms Maintain Much less ETH in 2025

On the shut of November 2024, Bitcoin.com Information detailed that liquid staking protocols collectively secured 13.85 million ETH. Since that report, holdings in these platforms have declined by 70,000 ether. Liquid staking derivatives (LSDs) have emerged as a transformative instrument inside decentralized finance (defi), enabling customers to stake cryptocurrencies whereas sustaining liquidity.

Supply: Defillama

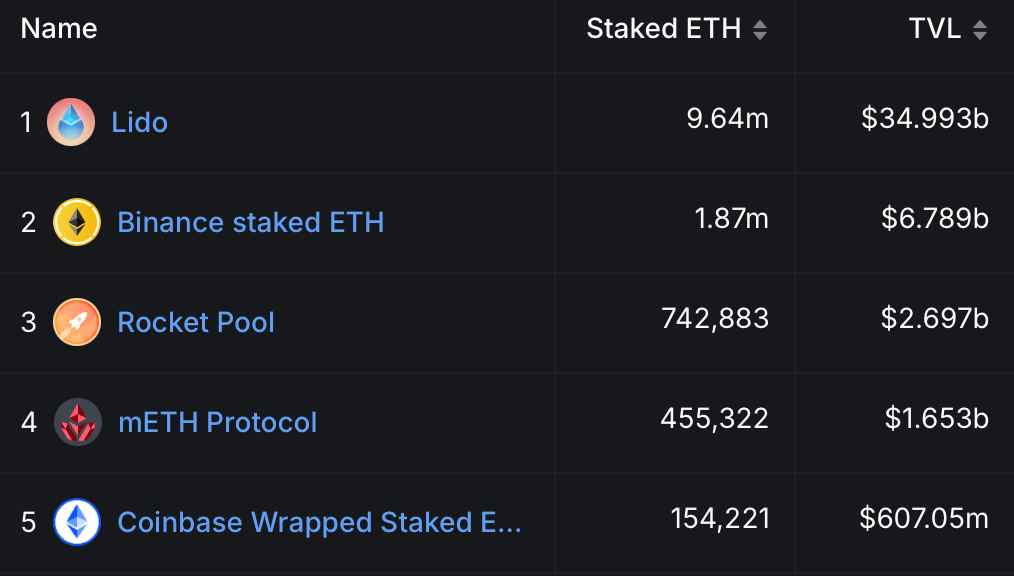

Conventional staking usually required locking up belongings, rendering them unavailable for different monetary actions. LSDs clear up this limitation by creating by-product tokens that symbolize the staked belongings, granting customers the flexibility to earn staking rewards with out relinquishing entry to their funds. Amongst these platforms, Lido reigns supreme, at present accounting for 69.96% of the 13.78 million ether held in LSD protocols.

This dominance interprets to 9.64 million ETH, valued at $34.9 billion. But, Lido’s holdings have dipped—down 160,000 ether since Nov. 30, 2024, when it as soon as managed 9.8 million ETH. In the meantime, Binance’s liquid staking platform has gained an excessive amount of traction, accumulating 150,000 ether over the previous 36 days. Rocket Pool, nevertheless, has skilled persistent outflows, shedding 479,374 ether between Oct. 29 to the tip of November, and now an extra 7,743 ether within the final 36 days.

Supply: Defillama

The 13.78 million ether at present locked in LSD platforms represents 11.44% of the circulating provide of 120,474,080 ethereum. This decline prompts reflection on the evolving preferences of present defi contributors. Whereas Lido stays the dominant pressure, its lowered holdings recommend even market leaders will not be proof against shifting person priorities or exterior components. Binance’s development, however, spotlights intensifying competitors, however the total lower in locked ether may point out broader hesitation inside the neighborhood.