Ethereum is getting ready to a vital check as current knowledge signifies a possible continuation of its downward development.

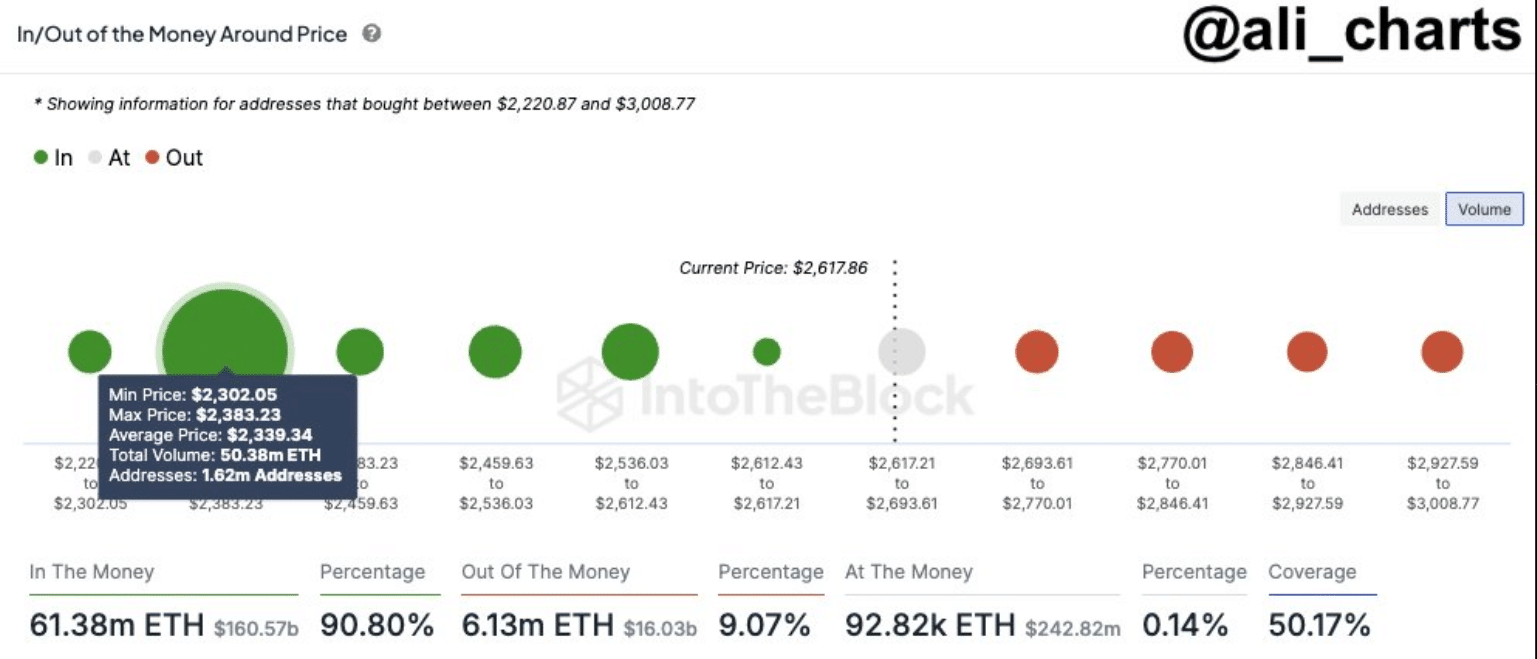

In a current replace, crypto analyst Ali Martinez highlighted a key assist zone between $2,300 and $2,380 for Ethereum. The analyst revealed that inside this vary, roughly 1.62 million addresses collectively held 50.38 million ETH on the time of the replace.

The importance of this assist zone lies within the giant quantity of ETH held by these addresses. It represents the most important cluster of consumers who entered the Ethereum market after the $2,200 stage to $3,000.

For comparability, within the $2,430 to $2,507 vary, 1.4 million addresses maintain solely 3.74 million ETH, whereas within the $2,278 to $2,340 vary, 1.89 million wallets maintain 50.4 million ETH.

This focus means that bearish market stress will doubtless be extra strongly defended across the $2,300 stage, making it a important level for market watchers.

Most Ethereum Traders In Revenue

With Ethereum’s value at $2,617, over 61 million gathered ETH tokens are “within the cash,” that means traders are holding them at a revenue. These tokens symbolize 90.80% of all Ethereum tokens bought throughout the $2,220 to $3,000 value vary, indicating that almost all ETH holders are nonetheless in revenue.

Moreover, in keeping with Martinez’s chart, there’s an “On the Cash” value vary between $2,617.21 and $2,693.61. On this vary, 92.82k addresses maintain $242.82 million value of ETH, the place traders are neither in revenue nor at a loss.

This vary displays a present equilibrium level, offering perception into the continued battle between consumers and sellers. Nevertheless, Ethereum’s value should keep above these ranges to keep away from additional bearish momentum.

IntoTheBlock

Bearish Patterns Highlighted by Market Veteran

Famend market veteran Peter Brandt lately contributed to the bearish sentiment surrounding Ethereum. Brandt highlighted a rising wedge formation on a four-hour chart, a sample typically seen as a precursor to a bearish reversal.

This week, Ethereum’s value retested a breakout level, briefly spiking above $2,700, however the momentum rapidly pale. Brandt additionally noticed that the 18-period easy transferring common (SMA) acts as resistance on the wedge’s higher boundary, additional weakening the upward development.

Moreover, the declining common directional index (ADX) signifies a scarcity of sturdy directional motion out there, reinforcing the chance of a downward breakout.

ETH Lengthy-Time period Projections

Amid the present market uncertainty, some analysts stay optimistic about Ethereum’s long-term potential. A current CoinGecko research presents various value predictions, with estimates starting from $4,400 to $166,000. Cathie Wooden of Ark Make investments provides probably the most bullish forecast, projecting an increase to $166,000 by 2032.

In the meantime, different analysts recommend extra modest short-term good points, with predictions ranging between $6,000 and $8,000. As Ethereum hovers close to essential assist, these projections spotlight the contrasting views on its future trajectory, making this a pivotal second for ETH holders.